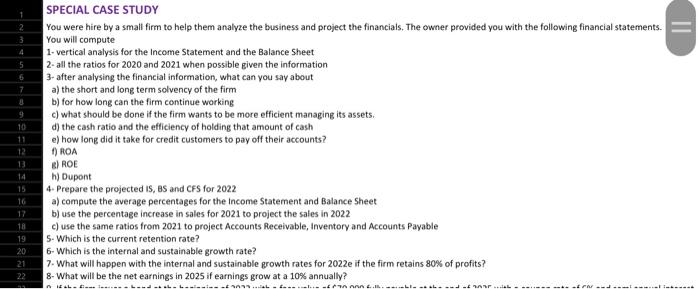

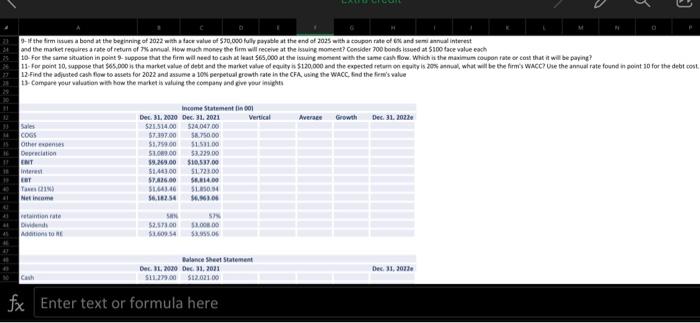

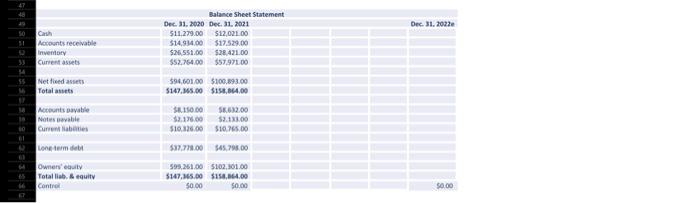

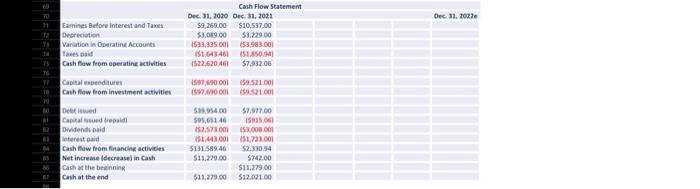

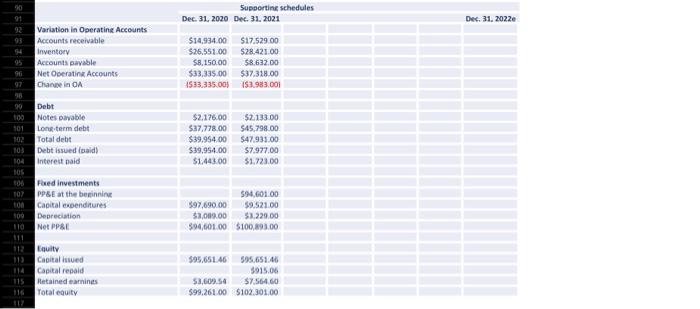

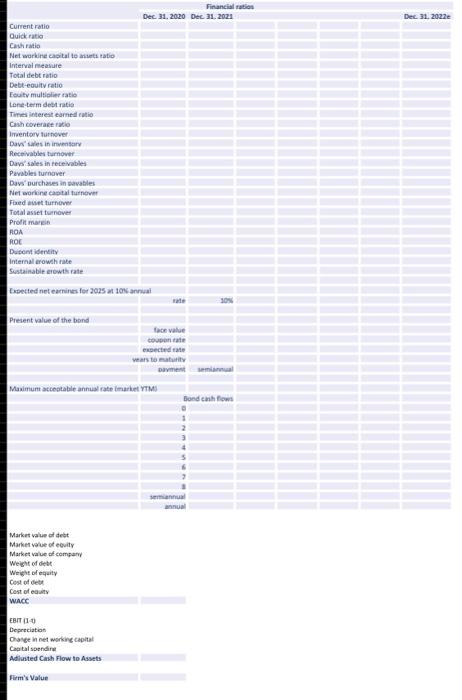

You were hire by a small firm to help them analyze the business and project the financials. The owner provided you with the following financial statements. You will compute 1- vertical analysis for the Income Statement and the Balance Sheet 2- all the ratios for 2020 and 2021 when possible given the information 3- after analysing the financial information, what can you say about a) the short and long term solvency of the firm b) for how long can the firm continue working c) what should be done if the firm wants to be more efficient managing its assets. d) the cash ratio and the efficiency of holding that amount of cash e) how long did it take for credit customers to pay off their accounts? f) POA B) ROE h) Dupont 4. Prepare the projected IS, BS and CFS for 2022 a) compute the average percentages for the Income Statement and Balance Sheet b) use the percentage increase in sales for 2021 to project the sales in 2022 c) use the same ratios from 2021 to project Accounts Receivable, Inventory and Accounts Payable 5. Which is the current retention rate? 6. Which is the internal and sustainable growth rate? 7. What will happen with the internal and sustainable growth rates for 2022e if the firm retains 80% of profits? 8- What will be the net earnings in 2025 if earnings grow at a 10% annually? 9-If the Arm isiues a bend at the begiening of 2022 with a tace walue of 520.000 fully puyate at the end of 2025 with a coupon rate of ix and wemr innual interest and the market requires a rate of return of 7% amual How much moner the firm will receive at the iswing moccent? Consider 700 bonds issued at 5100 tace walse eash 12. Find the adiuated cash flow boasieta for 2022 and assume a 10 N serpetual ereath rate is the CFA, usine the WacC, find the frre's walve t). Compare yeur walwation with how the market is vilueng the company and gee ptour invights Financial ration Dec. 31, 2020 Dec. 31. 2021 Dec. 31, 2022t Current ratio Quick ratio Cash ratio Net workine capital te anveti tatio Interval neaware Total debt ratio Detet-eouity ratio Feutv multiplier catio Lene-term dett nation Tines interest canned eatio: Cash corerase ratio imientory fur hover. Davs" sakes in irsenasary Receivables turnover Davo's ales in receivables Pavables turnaver Davs" burchases in davables Het eorishe castal tutnover Fiaed asset turnever Total asset twenover Prolit mareb Ron PoC Duscent ideneity Internal arowah race Sustainable erowts rate Easetted net earnines fer 2025 at 100 annual Present value of the bond Masimum acceotable annual rate imariet YTMU) Market value of dest Market verue of ecuity Market value of eompary Weight of dett Weipht of equaty Cest of debt Cest of easiay whace EBIT (1-4) Depreciation Oravge in net working capital Cop tal soendire Adilusted Cash Flow to Assets Firm's Value You were hire by a small firm to help them analyze the business and project the financials. The owner provided you with the following financial statements. You will compute 1- vertical analysis for the Income Statement and the Balance Sheet 2- all the ratios for 2020 and 2021 when possible given the information 3- after analysing the financial information, what can you say about a) the short and long term solvency of the firm b) for how long can the firm continue working c) what should be done if the firm wants to be more efficient managing its assets. d) the cash ratio and the efficiency of holding that amount of cash e) how long did it take for credit customers to pay off their accounts? f) POA B) ROE h) Dupont 4. Prepare the projected IS, BS and CFS for 2022 a) compute the average percentages for the Income Statement and Balance Sheet b) use the percentage increase in sales for 2021 to project the sales in 2022 c) use the same ratios from 2021 to project Accounts Receivable, Inventory and Accounts Payable 5. Which is the current retention rate? 6. Which is the internal and sustainable growth rate? 7. What will happen with the internal and sustainable growth rates for 2022e if the firm retains 80% of profits? 8- What will be the net earnings in 2025 if earnings grow at a 10% annually? 9-If the Arm isiues a bend at the begiening of 2022 with a tace walue of 520.000 fully puyate at the end of 2025 with a coupon rate of ix and wemr innual interest and the market requires a rate of return of 7% amual How much moner the firm will receive at the iswing moccent? Consider 700 bonds issued at 5100 tace walse eash 12. Find the adiuated cash flow boasieta for 2022 and assume a 10 N serpetual ereath rate is the CFA, usine the WacC, find the frre's walve t). Compare yeur walwation with how the market is vilueng the company and gee ptour invights Financial ration Dec. 31, 2020 Dec. 31. 2021 Dec. 31, 2022t Current ratio Quick ratio Cash ratio Net workine capital te anveti tatio Interval neaware Total debt ratio Detet-eouity ratio Feutv multiplier catio Lene-term dett nation Tines interest canned eatio: Cash corerase ratio imientory fur hover. Davs" sakes in irsenasary Receivables turnover Davo's ales in receivables Pavables turnaver Davs" burchases in davables Het eorishe castal tutnover Fiaed asset turnever Total asset twenover Prolit mareb Ron PoC Duscent ideneity Internal arowah race Sustainable erowts rate Easetted net earnines fer 2025 at 100 annual Present value of the bond Masimum acceotable annual rate imariet YTMU) Market value of dest Market verue of ecuity Market value of eompary Weight of dett Weipht of equaty Cest of debt Cest of easiay whace EBIT (1-4) Depreciation Oravge in net working capital Cop tal soendire Adilusted Cash Flow to Assets Firm's Value