Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You were hired as a consultant to Fam LLC. You were provided with the following data: Target capital structure: 35 percent debt, 10 percent preferred,

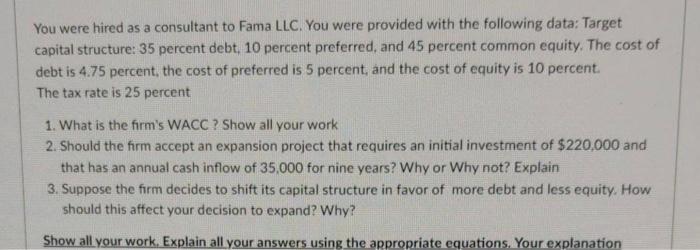

You were hired as a consultant to Fam LLC. You were provided with the following data: Target

capital structure: 35 percent debt, 10 percent preferred, and 45 percent common equity. The cost of

debt is 4.75 percent, the cost of preferred is 5 percent, and the cost of equity is 10 percent.

The tax rate is 25 percent

1. What is the firm's WACC ? Show all your work

2. Should the firm accept an expansion project that requires an initial investment of $220,000 and

that has an annual cash inflow of 35.000 for nine years? Why or Why not? Explain

3. Suppose the firm decides to shift its capital structure in favor of more debt and less equity. How

should this affect your decision to expand? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started