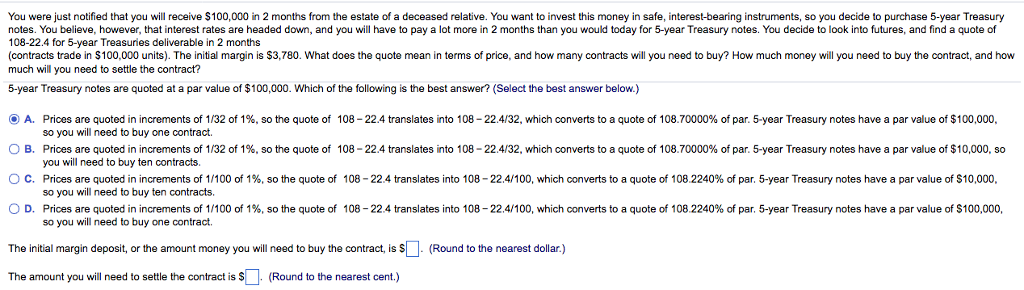

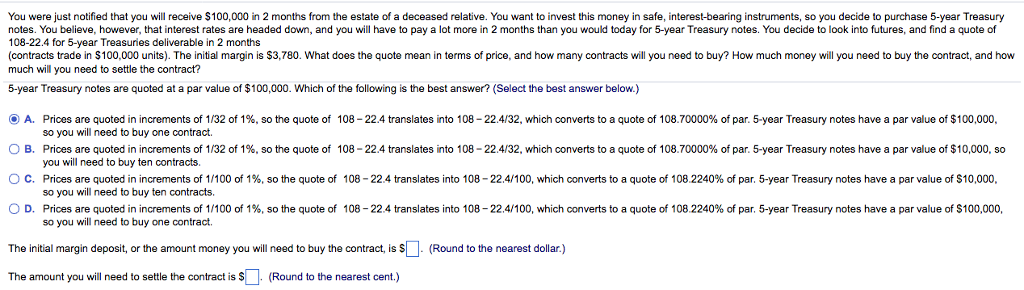

You were just notified that you will receive $100,000 in 2 months from the estate of a deceased relative. You want to invest this money in safe, interest-bearing instruments, so you decide to purchase 5-year Treasury notes. You believe, however, that interest rates are headed down, and you will have to pay a lot more in 2 months than you would today for 5-year Treasury notes. You decide to look into futures, and find a quote of 108-22.4 for 5-year Treasuries deliverable in 2 months (contracts trade in $100,000 units). The initial margin is $3,780. What does the quote mean in terms of price, and how many contracts will you need to buy? How much money will you need to buy the contract, and how much will you need to settle the contract? 5-year Treasury notes are quoted at a par value of $100,000. Which of the following is the best answer? (Select the best answer below.) O A. Prices are quoted in increments of 1/32 of 1%, so the quote of 108 -22.4 translates into 108 - 22.4/32, which converts to a quote of 108.70000% of par. 5-year Treasury notes have a par value of $100,000 so you will need to buy one contract. O B. Prices are quoted in increments of 1/32 of 1%, so the quote of 108 -22.4 translates into 108 -22.4/32, which converts to a quote of 108.70000% of par. 5-year Treasury notes have a par value of $10,000, so you will need to buy ten contracts. O C. Prices are quoted in increments of 1/100 of 1%, so the quote of 108 - 22.4 translates into 108 - 22.4/100, which converts to a quote of 108.2240% of par. 5-year Treasury notes have a par value of $10,000. so you will need to buy ten contracts. OD. Prices are quoted in increments of 1/100 of 1%, so the quote of 108 -22.4 translates into 108 -22.4/100, which converts to a quote of 108.2240% of par. 5-year Treasury notes have a par value of $100,000, so you will need to buy one contract. The initial margin deposit, or the amount money you will need to buy the contract, is S . (Round to the nearest dollar.) The amount you will need to settle the contract is S . (Round to the nearest cent.)