Question

You were recently hired as an entry-level bookkeeper for a service business that recently opened. This is the first month in operation for the business

You were recently hired as an entry-level bookkeeper for a service business that recently opened. This is the first month in operation for the business and your first task is to record business transactions for their first month using the source documents and transaction data the owner will provide to you. Because this is a small business that does not use computerized accounting, you will apply the accounting cycle in Excel to record transactions and generate financial reporting results for the owner.

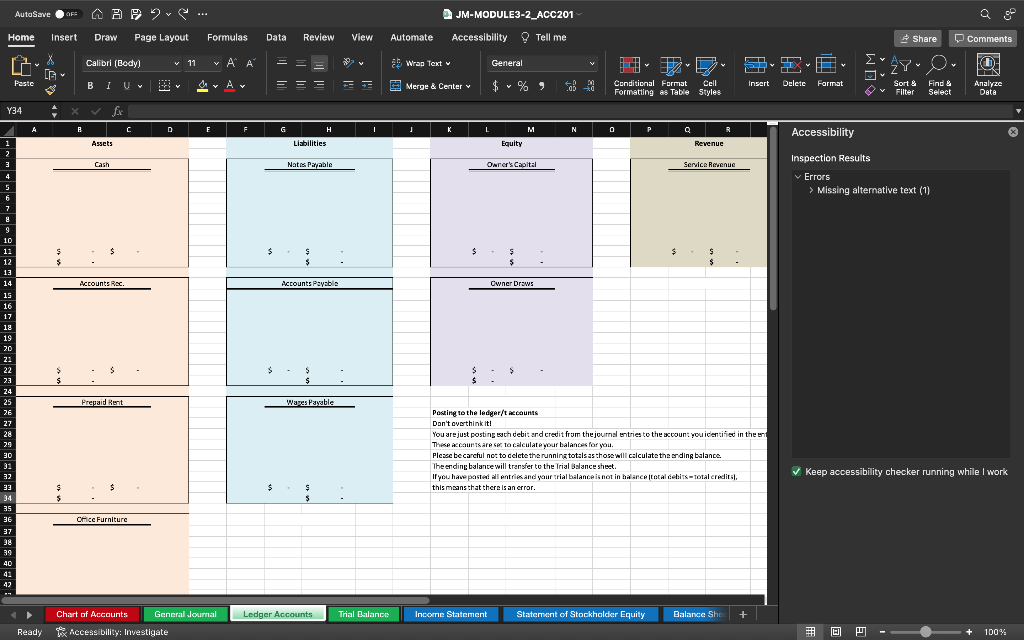

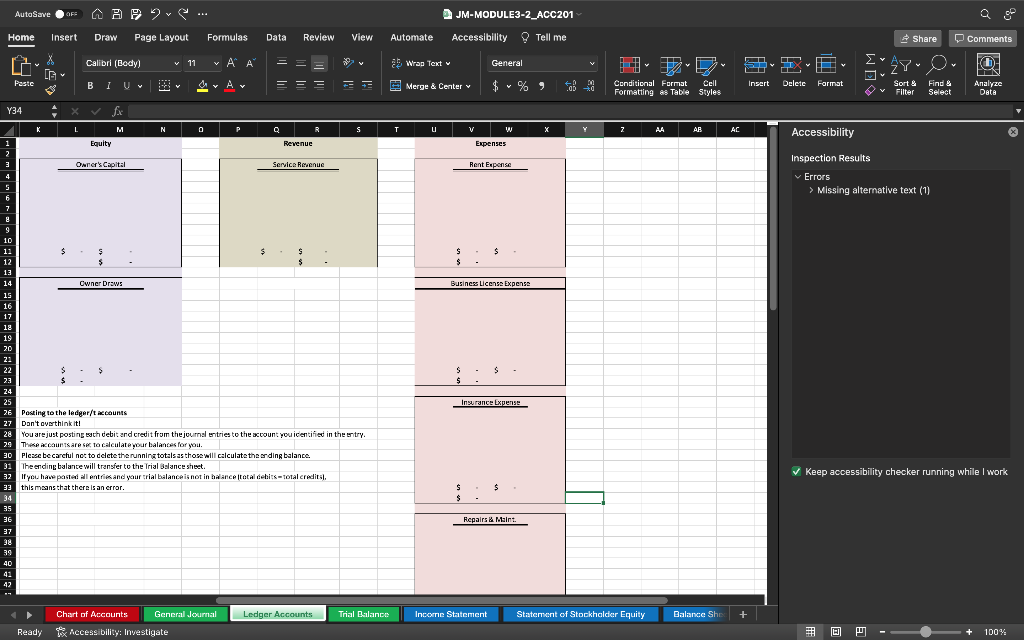

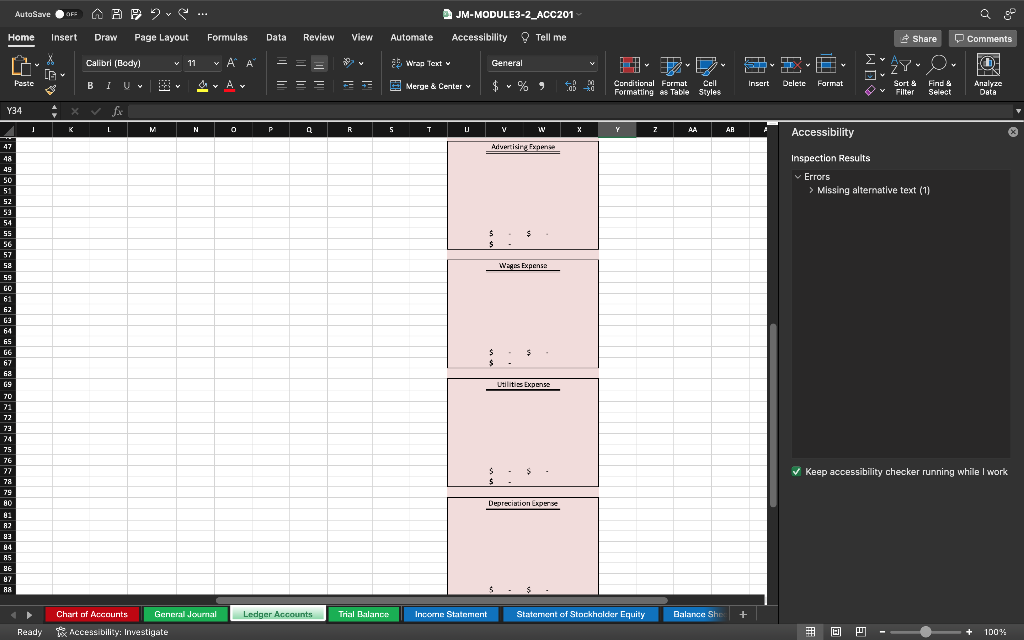

PLEASE PLEASE PLEASE I NEED THESE CHARTS BELOW FILLED OUT THE EXACT WAY I POSTED IT. PLEASE FOLLOW THE DIRECTIONS POSTED ON THE FIRST PICTURE, IN TERMS OF FILLING OUT THE CHARTS. I WILL POST CORRESPONDING JOURNAL ENTRIES CONTAINING JOURNAL ENTRIES WITH ALL THE INFORMATION NEEDED FOR THE CHARTS.

THESE CHARTS BELOW WILL HELP YOU WITH FILLING OUT THE ABOVE CHARTS. PLEASE FILL OUT SIMPLE AND UNDERSTANDABLE TO READ.

ACC 201 Accounting Data Appendix

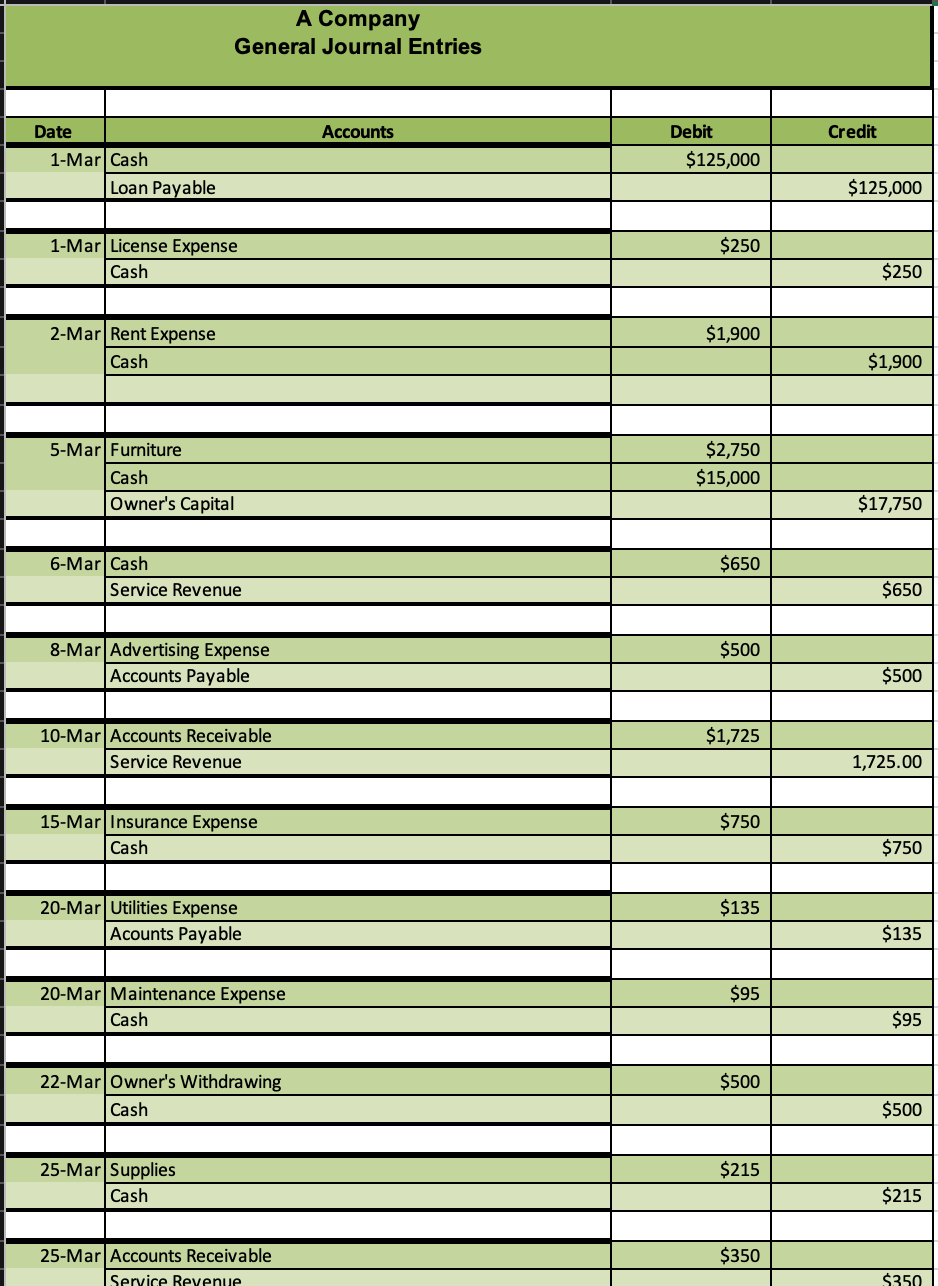

The following events occurred in March:

March 1: Owner borrowed $125,000 to fund/start the business. The loan term is 5 years.

March 1: Owner paid $250 to the county for a business license.

March 2: Owner signed lease on office space; paying first (March 20XX) and last months rent of $950 per month.

March 5: Owner contributed office furniture valued at $2,750 and cash in the amount of $15,000 to the business.

March 6: Owner performed service for client in the amount of $650. Customer paid in cash.

March 8: Owner purchased advertising services on account in the amount of $500.

March 10: Owner provided services to client on account, in the amount of $1,725.

March 15: Owner paid business insurance in the amount of $750.

March 20: The owner received first utility bill in the amount of $135, due in April.

March 20: Office copier required maintenance; owner paid $95.00 for copier servicing.

March 22: Owner withdrew $500 cash for personal use.

March 25: Owner paid $215 for office supplies.

March 25: Owner provided service to client in the amount of $350. Client paid at time of service.

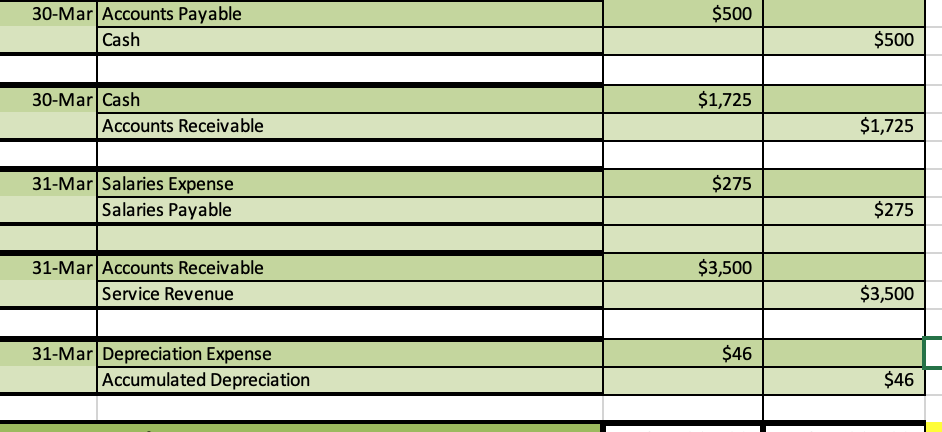

March 30: Owner paid balance due for advertising expense purchase on March 8.

March 30: Received payment from customer for March 10 invoice in the amount of $1,725.

March 31: Last day of pay period; owner owes part-time worker $275 for the March 16 through March 31 pay period. This will be paid on April 5.

March 31: Provided service for client on account in the amount of $3,500.

March 31: Record depreciation of the office furniture at $45.83.

Keep accessibility checker running while I work D JM-MODULE3-2_ACC201 Home Insert Draw Page Layout Formulas Data Review View Automate Accessibility \& Tell me mfx N Q R s T u v wx z Ah Accessibility Inspection Results Errors > Missing altemative text (1) Posting to the ledigar/t teccounts Don't avarthink it! You are just posting esch debit and eredit from the journsl untries to the account you icentified in the untry. Thexa accauntsara sac to calculat y your balances for you. Plezec becarcful net to deletetherunnina totsis as thosewill calculatethe arding balance Theending balante will transfer to the Trial bslance sheet. this mans that there is an error. Keep accessibility checker running while I work A Company General Journal Entries Keep accessibility checker running while I work D JM-MODULE3-2_ACC201 Home Insert Draw Page Layout Formulas Data Review View Automate Accessibility \& Tell me mfx N Q R s T u v wx z Ah Accessibility Inspection Results Errors > Missing altemative text (1) Posting to the ledigar/t teccounts Don't avarthink it! You are just posting esch debit and eredit from the journsl untries to the account you icentified in the untry. Thexa accauntsara sac to calculat y your balances for you. Plezec becarcful net to deletetherunnina totsis as thosewill calculatethe arding balance Theending balante will transfer to the Trial bslance sheet. this mans that there is an error. Keep accessibility checker running while I work A Company General Journal Entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started