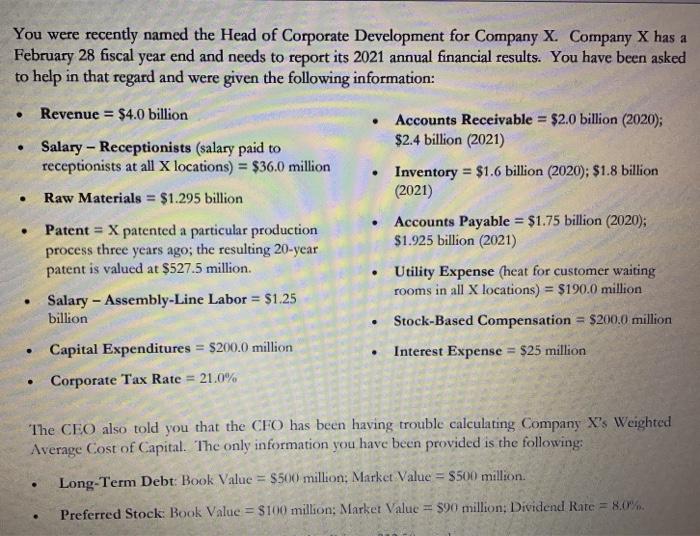

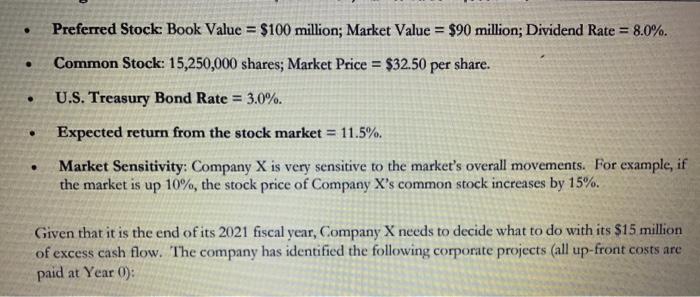

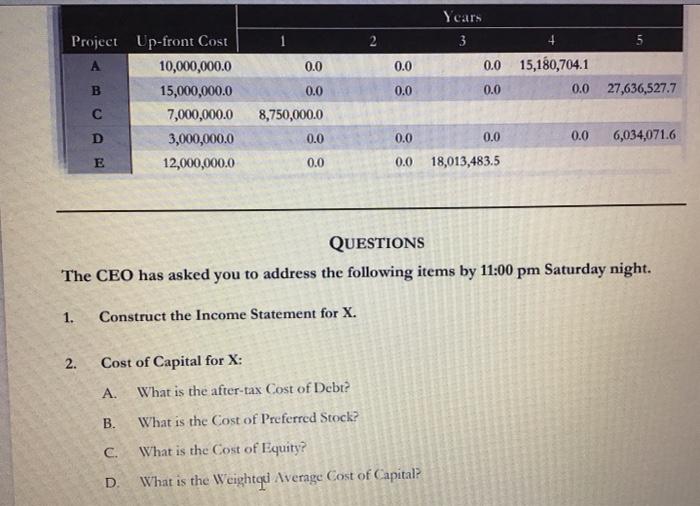

You were recently named the Head of Corporate Development for Company X. Company X has a February 28 fiscal year end and needs to report its 2021 annual financial results. You have been asked to help in that regard and were given the following information: . Revenue = $4.0 billion Salary - Receptionists (salary paid to receptionists at all X locations) = $36.0 million . Accounts Receivable = $2.0 billion (2020); $2.4 billion (2021) Inventory = $1.6 billion (2020): $1.8 billion (2021) Accounts Payable = $1.75 billion (2020); $1.925 billion (2021) . Raw Materials = $1.295 billion . Patent = X patented a particular production process three years ago, the resulting 20-year patent is valued at $527.5 million. Salary - Assembly-Line Labor = $1.25 billion Utility Expense (heat for customer waiting rooms in all X locations) = $190.0 million Stock-Based Compensation = $200.0 million Interest Expense = $25 million . Capital Expenditures = $200.0 million Corporate Tax Rate = 21.0% . The CEO also told you that the CFO has been having trouble calculating Company X's Weighted Average Cost of Capital. The only information you have been provided is the following Long-Term Debt: Book Value = $500 million: Market Value = $500 million . Preferred Stock Book Value = $100 million: Market Value = 590 million; Dividend Rate = 8.0%. . Preferred Stock: Book Value = $100 million; Market Value = $90 million; Dividend Rate = 8.0%. Common Stock: 15,250,000 shares; Market Price = $32.50 per share. . U.S. Treasury Bond Rate = 3.0%. Expected return from the stock market = 11.5%. Market Sensitivity: Company X is very sensitive to the market's overall movements. For example, if the market is up 10%, the stock price of Company X's common stock increases by 15%. Given that it is the end of its 2021 fiscal year, Company X needs to decide what to do with its $15 million of excess cash flow. The company has identified the following corporate projects (all up-front costs are paid at Year 0): Years 3 2 5 0.0 0.0 0.0 15,180,704.1 0.0 0.0 0.0 27,636,527.7 Project Up-front Cost A 10,000,000.0 B 15,000,000.0 7,000,000.0 3,000,000.0 E 12,000,000.0 0.0 8,750,000.0 0.0 0.0 0.0 0.0 6,034,071.6 0.0 0.0 18,013,483.5 QUESTIONS The CEO has asked you to address the following items by 11:00 pm Saturday night. 1. Construct the Income Statement for X. 2. Cost of Capital for X: A. What is the after-tax Cost of Debt? B. What is the Cost of Preferred Stock? C. What is the Cost of Equity? D What is the Weightqu Average Cost of Capital? You were recently named the Head of Corporate Development for Company X. Company X has a February 28 fiscal year end and needs to report its 2021 annual financial results. You have been asked to help in that regard and were given the following information: . Revenue = $4.0 billion Salary - Receptionists (salary paid to receptionists at all X locations) = $36.0 million . Accounts Receivable = $2.0 billion (2020); $2.4 billion (2021) Inventory = $1.6 billion (2020): $1.8 billion (2021) Accounts Payable = $1.75 billion (2020); $1.925 billion (2021) . Raw Materials = $1.295 billion . Patent = X patented a particular production process three years ago, the resulting 20-year patent is valued at $527.5 million. Salary - Assembly-Line Labor = $1.25 billion Utility Expense (heat for customer waiting rooms in all X locations) = $190.0 million Stock-Based Compensation = $200.0 million Interest Expense = $25 million . Capital Expenditures = $200.0 million Corporate Tax Rate = 21.0% . The CEO also told you that the CFO has been having trouble calculating Company X's Weighted Average Cost of Capital. The only information you have been provided is the following Long-Term Debt: Book Value = $500 million: Market Value = $500 million . Preferred Stock Book Value = $100 million: Market Value = 590 million; Dividend Rate = 8.0%. . Preferred Stock: Book Value = $100 million; Market Value = $90 million; Dividend Rate = 8.0%. Common Stock: 15,250,000 shares; Market Price = $32.50 per share. . U.S. Treasury Bond Rate = 3.0%. Expected return from the stock market = 11.5%. Market Sensitivity: Company X is very sensitive to the market's overall movements. For example, if the market is up 10%, the stock price of Company X's common stock increases by 15%. Given that it is the end of its 2021 fiscal year, Company X needs to decide what to do with its $15 million of excess cash flow. The company has identified the following corporate projects (all up-front costs are paid at Year 0): Years 3 2 5 0.0 0.0 0.0 15,180,704.1 0.0 0.0 0.0 27,636,527.7 Project Up-front Cost A 10,000,000.0 B 15,000,000.0 7,000,000.0 3,000,000.0 E 12,000,000.0 0.0 8,750,000.0 0.0 0.0 0.0 0.0 6,034,071.6 0.0 0.0 18,013,483.5 QUESTIONS The CEO has asked you to address the following items by 11:00 pm Saturday night. 1. Construct the Income Statement for X. 2. Cost of Capital for X: A. What is the after-tax Cost of Debt? B. What is the Cost of Preferred Stock? C. What is the Cost of Equity? D What is the Weightqu Average Cost of Capital