Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will be in graduate school for the next two years. You borrowed some money from the bank for your graduate education, which the

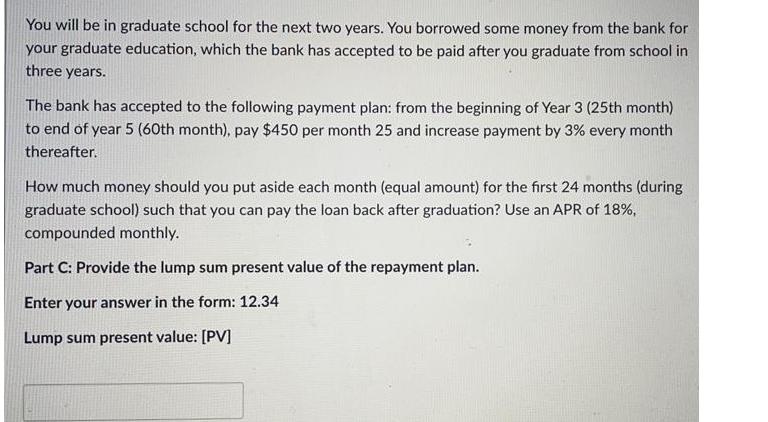

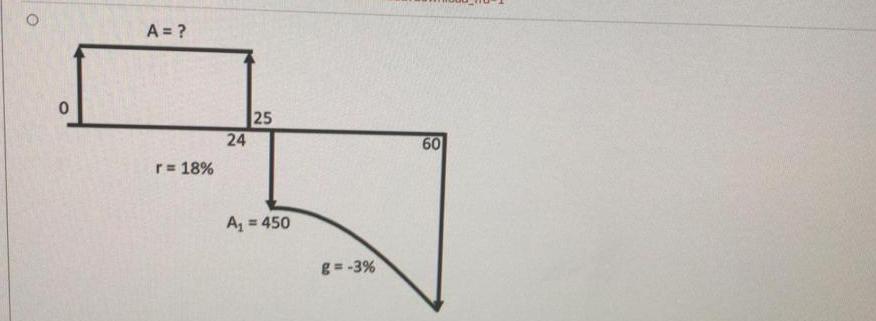

You will be in graduate school for the next two years. You borrowed some money from the bank for your graduate education, which the bank has accepted to be paid after you graduate from school in three years. The bank has accepted to the following payment plan: from the beginning of Year 3 (25th month) to end of year 5 (60th month), pay $450 per month 25 and increase payment by 3% every month thereafter. How much money should you put aside each month (equal amount) for the first 24 months (during graduate school) such that you can pay the loan back after graduation? Use an APR of 18%, compounded monthly. Part C: Provide the lump sum present value of the repayment plan. Enter your answer in the form: 12.34 Lump sum present value: [PV] O A = ? r = 18% 24 25 = 450 A = g=-3% 60

Step by Step Solution

★★★★★

3.54 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To determine the lump sum present value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started