Question

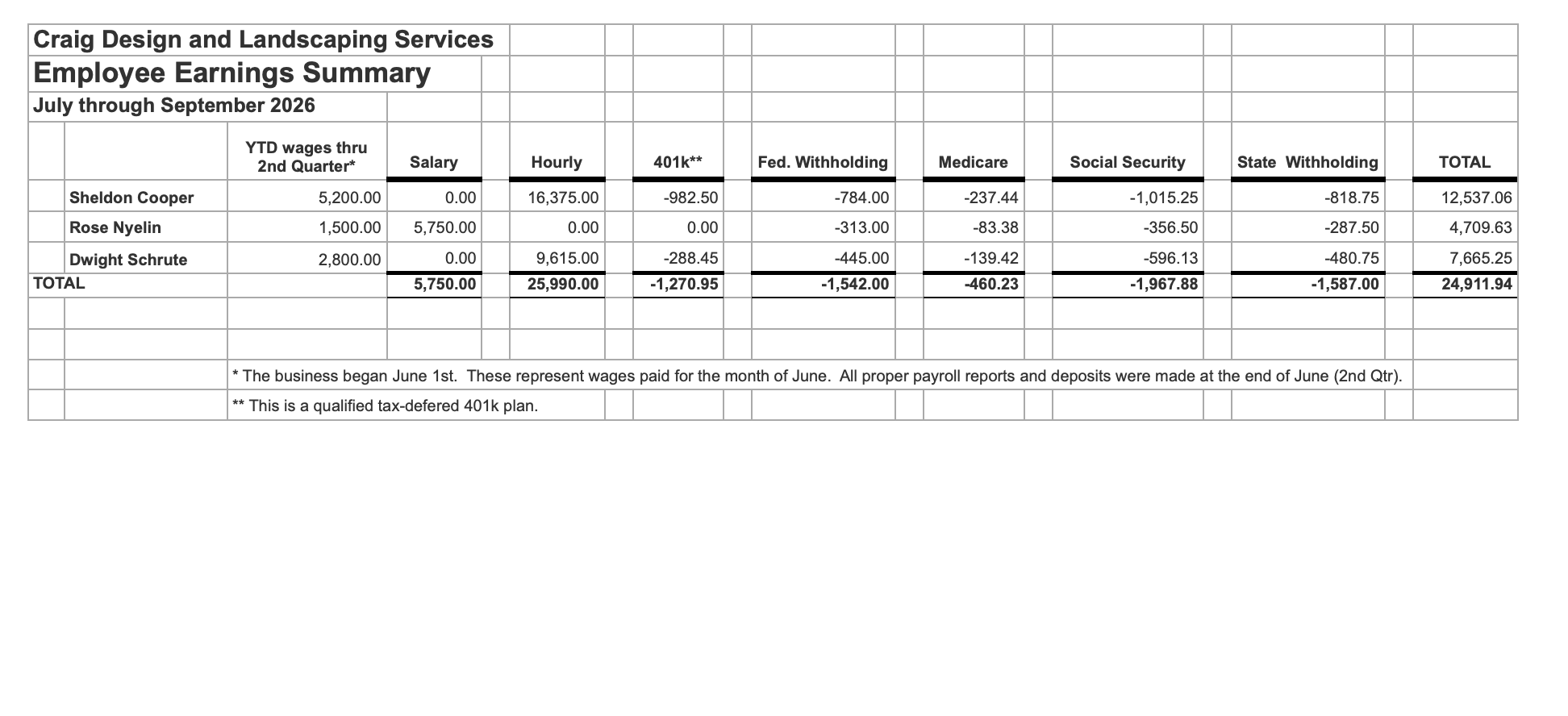

You will be preparing the quarterly payroll reports for Craig's Design and Landscaping. You will prepare the 941, WT-6 and the UCT-101 For purposes of

You will be preparing the quarterly payroll reports for Craig's Design and Landscaping. You will prepare the 941, WT-6 and the UCT-101

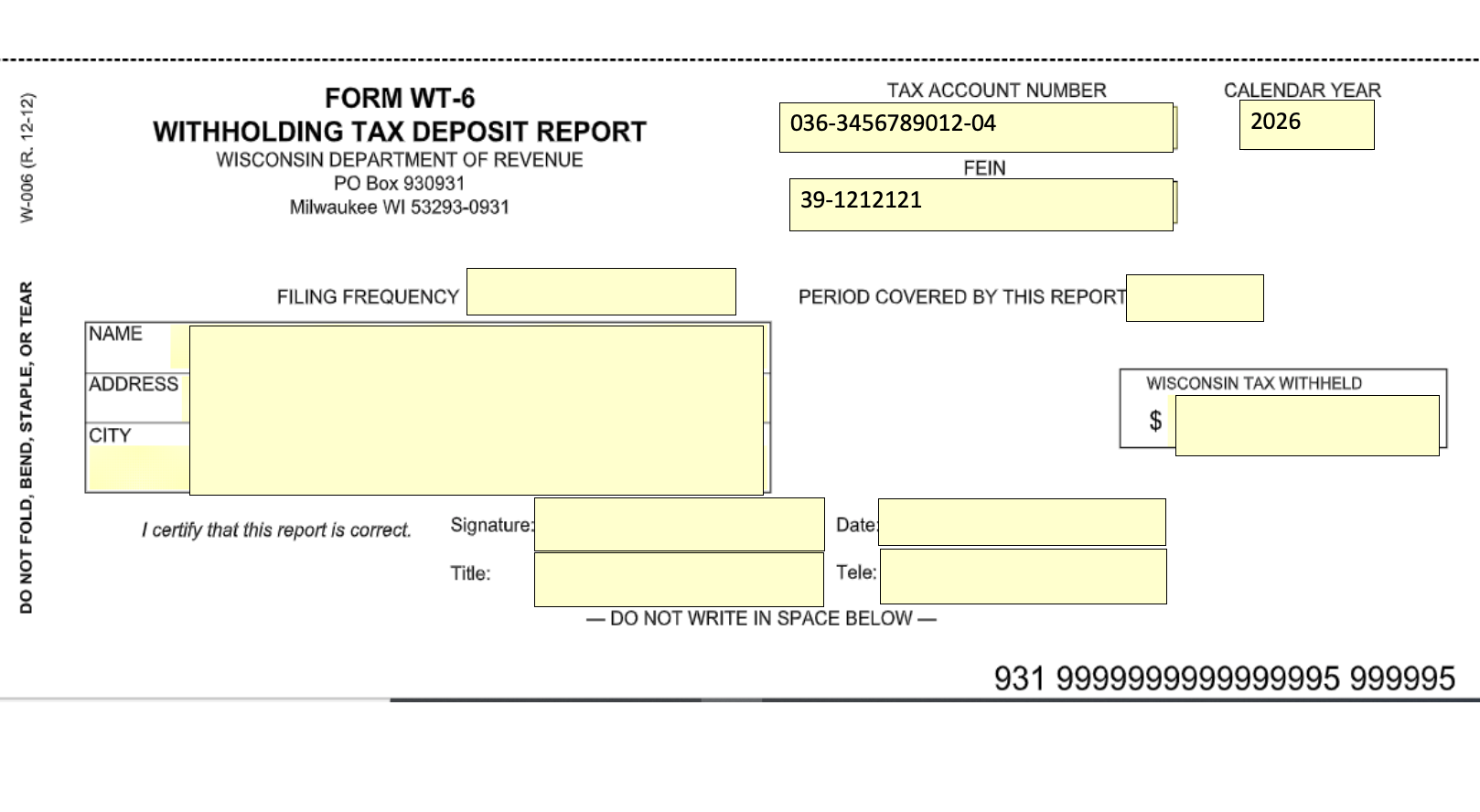

For purposes of this assignment let's assume Craig's Design and Landscaping is located in Wisconsin.

Company name and address:

Craigs Design and Landscaping Services

123 Sierra Way

Cherryville, WI 52415

(262) 945-4069

Employer Identification number (EIN) 39-1212121

Wisconsin and UI Tax Account Number 36-3456789012-04

Additional Information for the 941:

Depending upon when you took your payroll class; form 941 may now look a little different; after COVID more payroll tax breaks were given and some modifications were made. You will still however complete the form the same way. Please see additional information below as well as the 941 instructions

Part 1:

Lines 1 - 4. Are the same as previous years. Click here to determine if you include 401k deductions on line 2. (Also see note on Employee Earnings Summary)

Line 5a - d. You will only enter data on lines 5a and 5c

Lines 11a - g have been added/modified and will be skipped.*

Line 12 is where your total taxes from line 10 will be reported.

Line 13a will be completed by you.

Lines 13b- f have been added/modified and will be skipped.*

Line 13g will be completed (same amount as 13a)

Lines 13h and i will be skipped.*

Hint: Line 12 and 13g will match and there will be no balance due or overpayment

*These are being skipped because they are not relevant to Craigs business.

Part 2:

Craig is a monthly schedule depositor for 941 purposes.

941 payments made during 3rd Quarter: (information obtained from the EFTPS tax deposits)

July: $2,130.75

August $1,955.28

September $2,312.19

Part 3:

No question applies to Craigs Landscaping business

Part 4:

Record yourself as the third party designee for the 941 - select your own PIN

Part 5:

You ask Craig Smith, President to sign the 941 on October 15th, 2026

Additional Information for the UCT-101:

Even though you probably have not completed an UCT-101 form, it is very similar in content to the 940-EZ (FUTA). You have calculated SUTA taxes in your payroll class, but not completed the form. Click here for the UCT-101 instructions (page 2).

Craigs Design and Landscaping tax rate for SUTA is 4.5%. It must be entered on line 12 as .0450

Section 3 and 4 are not fillable and can be left blank. The Wisconsin Department of Employment Security populates these sections for the company.

You ask Craig Smith, President to sign the UTC-101 on October 15th, 2026

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started