Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will be provided with a case study and data for the program. 2. Develop a pseudocode and flow chart that demonstrates the design process

You will be provided with a case study and data for the program. 2. Develop a pseudocode and flow chart that demonstrates the design process for the program. 3. Develop a Python 3 program that calculates an employee's income based on the provided data and includes deductions for income tax and superannuation. 4. The program should include appropriate comments and be clearly organised into functions and loops. 5. You cannot use modules, dictionaries, files, or classes, but only lists, loops, and functions. Optionally, you may or may not use strings.

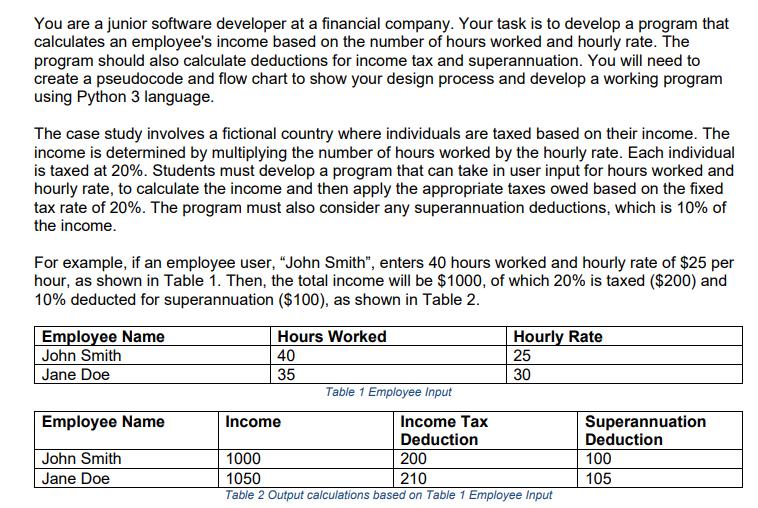

You will be provided with a case study and data for the program. 2. Develop a pseudocode and flow chart that demonstrates the design process for the program. 3. Develop a Python 3 program that calculates an employee's income based on the provided data and includes deductions for income tax and superannuation. 4. The program should include appropriate comments and be clearly organised into functions and loops. 5. You cannot use modules, dictionaries, files, or classes, but only lists, loops, and functions. Optionally, you may or may not use strings. You are a junior software developer at a financial company. Your task is to develop a program that calculates an employee's income based on the number of hours worked and hourly rate. The program should also calculate deductions for income tax and superannuation. You will need to create a pseudocode and flow chart to show your design process and develop a working program using Python 3 language. The case study involves a fictional country where individuals are taxed based on their income. The income is determined by multiplying the number of hours worked by the hourly rate. Each individual is taxed at 20%. Students must develop a program that can take in user input for hours worked and hourly rate, to calculate the income and then apply the appropriate taxes owed based on the fixed tax rate of 20%. The program must also consider any superannuation deductions, which is 10% of the income. For example, if an employee user, "John Smith", enters 40 hours worked and hourly rate of $25 per hour, as shown in Table 1. Then, the total income will be $1000, of which 20% is taxed ($200) and 10% deducted for superannuation ($100), as shown in Table 2. Employee Name John Smith Jane Doe Employee Name John Smith Jane Doe Hours Worked 40 35 Income Table 1 Employee Input Income Tax Deduction Hourly Rate 25 30 1000 200 1050 210 Table 2 Output calculations based on Table 1 Employee Input Superannuation Deduction 100 105

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Certainly Heres a pseudocode and a Python 3 program that calculates an employees income based on the provided data and includes deductions for income tax and superannuation Pseudocode 1 Initialize an ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started