Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will be required to answer the following questions and show your steps for your calculations based on the information from your analysis (you

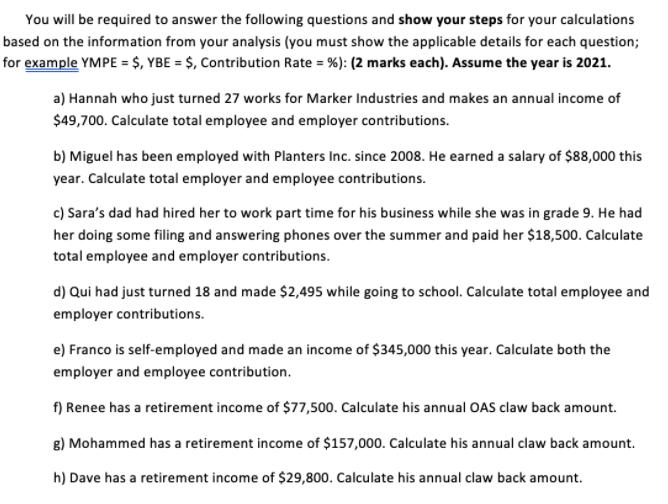

You will be required to answer the following questions and show your steps for your calculations based on the information from your analysis (you must show the applicable details for each question; for example YMPE = $, YBE = $, Contribution Rate = %): (2 marks each). Assume the year is 2021. a) Hannah who just turned 27 works for Marker Industries and makes an annual income of $49,700. Calculate total employee and employer contributions. b) Miguel has been employed with Planters Inc. since 2008. He earned a salary of $88,000 this year. Calculate total employer and employee contributions. c) Sara's dad had hired her to work part time for his business while she was in grade 9. He had her doing some filing and answering phones over the summer and paid her $18,500. Calculate total employee and employer contributions. d) Qui had just turned 18 and made $2,495 while going to school. Calculate total employee and employer contributions. e) Franco is self-employed and made an income of $345,000 this year. Calculate both the employer and employee contribution. f) Renee has a retirement income of $77,500. Calculate his annual OAS claw back amount. g) Mohammed has a retirement income of $157,000. Calculate his annual claw back amount. h) Dave has a retirement income of $29,800. Calculate his annual claw back amount.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

3 a Employer and employee contribution in Hannahs case 251790 b Employer and employee contribution i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started