Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will buy several items before that start of your business: a. A computer and a printer: You will pay $6,000 (including taxes, shipping

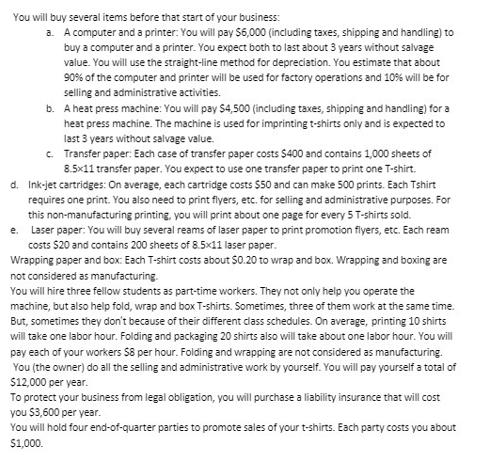

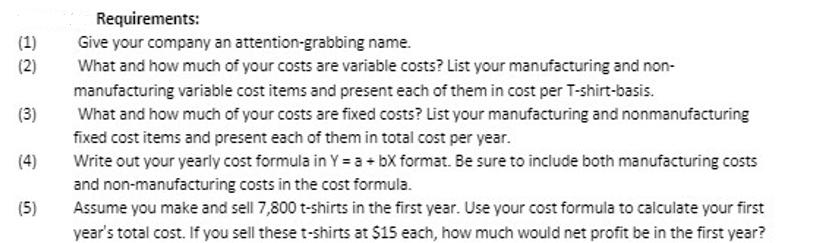

You will buy several items before that start of your business: a. A computer and a printer: You will pay $6,000 (including taxes, shipping and handling) to buy a computer and a printer. You expect both to last about 3 years without salvage value. You will use the straight-line method for depreciation. You estimate that about 90% of the computer and printer will be used for factory operations and 10% will be for selling and administrative activities. b. A heat press machine: You will pay $4,500 (including taxes, shipping and handling) for a heat press machine. The machine is used for imprinting t-shirts only and is expected to last 3 years without salvage value. c. Transfer paper: Each case of transfer paper costs $400 and contains 1,000 sheets of 8.5x11 transfer paper. You expect to use one transfer paper to print one T-shirt. d. Ink-jet cartridges: On average, each cartridge costs $50 and can make 500 prints. Each Tshirt requires one print. You also need to print flyers, etc. for selling and administrative purposes. For this non-manufacturing printing, you will print about one page for every 5 T-shirts sold. Laser paper: You will buy several reams of laser paper to print promotion flyers, etc. Each ream costs $20 and contains 200 sheets of 8.5x11 laser paper. Wrapping paper and box: Each T-shirt costs about $0.20 to wrap and box. Wrapping and boxing are not considered as manufacturing. You will hire three fellow students as part-time workers. They not only help you operate the machine, but also help fold, wrap and box T-shirts. Sometimes, three of them work at the same time. But, sometimes they don't because of their different class schedules. On average, printing 10 shirts will take one labor hour. Folding and packaging 20 shirts also will take about one labor hour. You will pay each of your workers $8 per hour. Folding and wrapping are not considered as manufacturing. You (the owner) do all the selling and administrative work by yourself. You will pay yourself a total of $12,000 per year. e. To protect your business from legal obligation, you will purchase a liability insurance that will cost you $3,600 per year. You will hold four end-of-quarter parties to promote sales of your t-shirts. Each party costs you about $1,000. (1) (2) (3) (5) Requirements: Give your company an attention-grabbing name. What and how much of your costs are variable costs? List your manufacturing and non- manufacturing variable cost items and present each of them in cost per T-shirt-basis. What and how much of your costs are fixed costs? List your manufacturing and nonmanufacturing fixed cost items and present each of them in total cost per year. Write out your yearly cost formula in Y = a + bx format. Be sure to include both manufacturing costs and non-manufacturing costs in the cost formula. Assume you make and sell 7,800 t-shirts in the first year. Use your cost formula to calculate your first year's total cost. If you sell these t-shirts at $15 each, how much would net profit be in the first year?

Step by Step Solution

★★★★★

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 AttentionGrabbing Company Name Trendy Prints Inc 2 Variable Costs Manufacturing Variable Costs per ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started