Question

You will compare 2 different amortization schedules when buying a car. The purchase price is $17,500. Bank A requires a 20% down payment and has

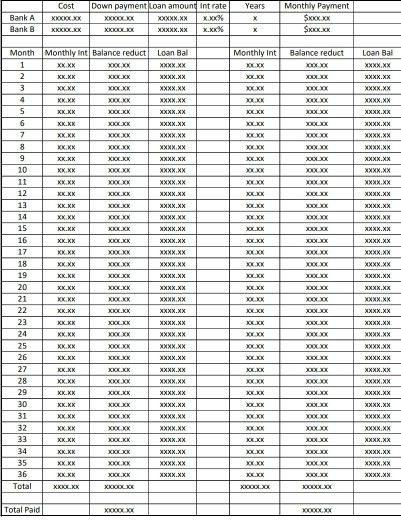

You will compare 2 different amortization schedules when buying a car. The purchase price is $17,500. Bank A requires a 20% down payment and has an annual interest rate of 3.6%. Bank B wants only 10% down payment but the annual interest rate is 4.8%. In both banks, the loan will be paid off in 3 years. Formulas: A.First you need to set up the formula to find the monthly payment. Use the PMT function under FINANCIAL FORMULAS. B. After calculating the monthly payment, set up the formulas for the monthly interest, balance reduction, and loan balance. Finally, calculate the total interest paid on the loan under the Monthly interest column and the total under the Balance reduction (Which should match the loan amount borrowed). Use the Autosum formula. C. The first row should use the initial loan amount for the calculation of the Monthly interest. The second row should use the Loan Balance. Once you have the formulas for the second row, drag the arrow down to fill out all the remaining rows. Remember that in Excel you need to enter = before the formula so it knows to compute the formula in the cell and doesnt think its just a heading or label. D. You may also adjust the number of decimal places by clicking on the increase decimals or decrease decimals tab under NUMBER on the HOME page. E. Your formulas should only have cell references. The only numbers youre allowed to type in are the Beginning Balances, the interest rates and the years. F. Lastly, have Excel calculate the total amount paid for the car if you choose Bank A and Bank B. Make sure you add the down payment, interest and loan amount.

can you please let me know what equations you use for excel functions

Cost Down payment Loan amount Intrate Years Monthly Payment SIEK SEX Bank B RIDGE ODDESDE U X Month Loan Monthly Int Balance reduct Loan Bal Monthly in Balance reduct WE NE XOX XXXX KLICK XOCO XXXX XXX XXXX EX XXXX XOXOX XXX Total PaidStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started