Question

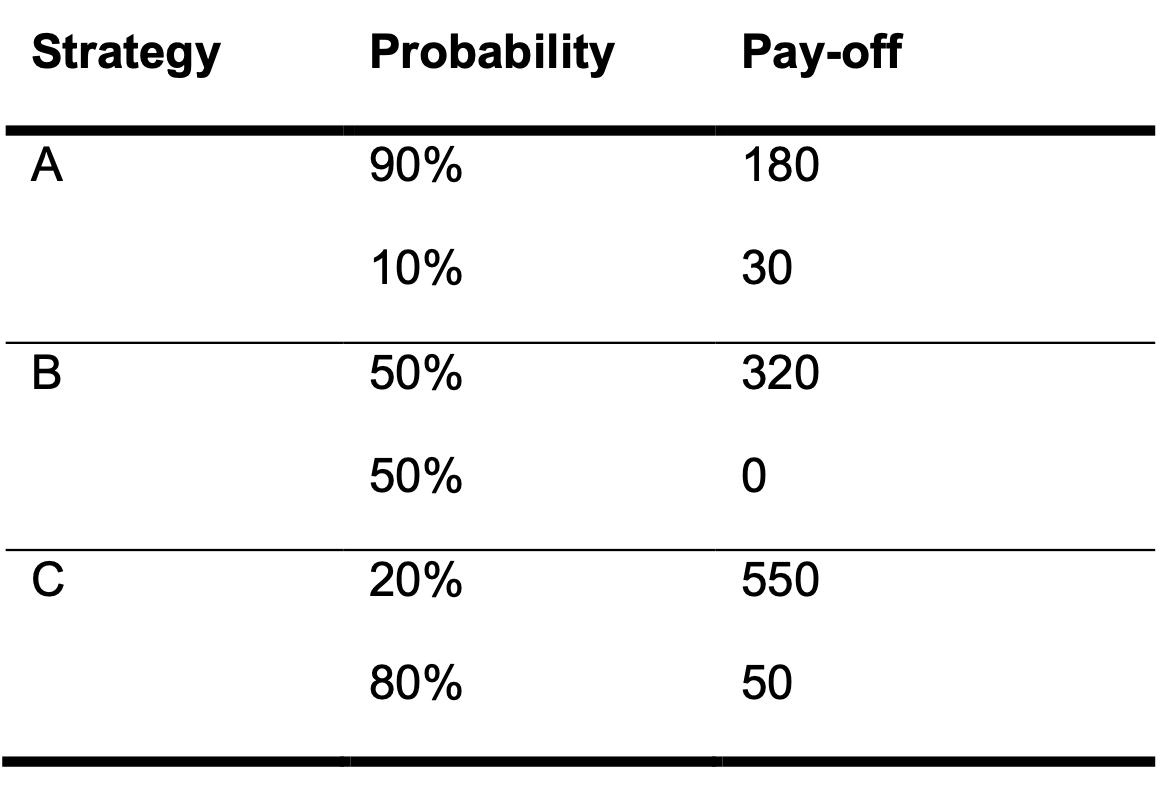

Novapharm must choose one of three different investment strategies. The payoffs (after-tax) and their likelihood for each strategy are shown below. The risk of each

Novapharm must choose one of three different investment strategies. The payoffs (after-tax) and their likelihood for each strategy are shown below. The risk of each project is diversifiable.

1. Which project has the highest expected payoff?

2. Suppose Novapharm has debt of $100 million due at the time of the project’s payoff. Which project has the highest expected payoff for equity holders?

3. Suppose Novapharm has debt of $250 million due at the time of the project’s payoff. Which project has the highest expected payoff for equity holders?

4. If management chooses the strategy that maximizes the payoff to equity holders, what is the expected agency cost to the firm from having $100 million in debt due?

5. What is the expected agency cost to the firm from having $250 million in debt due?

6. From a theoretical perspective, what is the market imperfection that generates the agency costs highlighted in the previous questions?

Strategy A B C Probability 90% 10% 50% 50% 20% 80% Pay-off 180 30 320 0 550 50

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 Which project has the highest expected payoff The project with the highest expected payoff is Strategy A which has a 90 probability of yielding a pa...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started