Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You will likely be able/not be able (put in appropriate choice here, removing red coaching) to borrow $37,000 to buy the bus under the

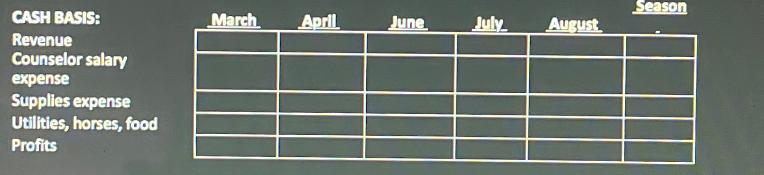

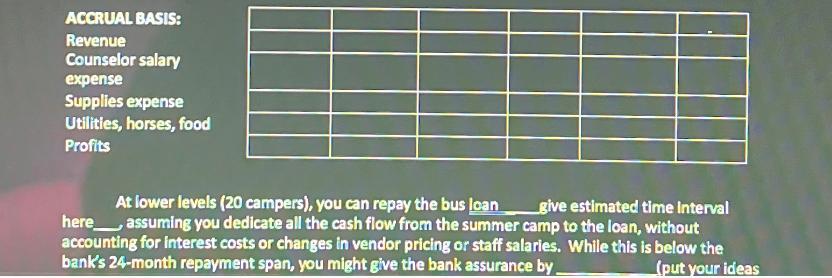

You will likely be able/not be able (put in appropriate choice here, removing red coaching) to borrow $37,000 to buy the bus under the bank's current terms. Your profits for a typical year is $xxxxxxx with 20 campers and $10.00x with 30 campers. That forecast is based current tuition and costs of running the camp, which can change. A schedule of the cash flows and the profits by month are shown below. Notice the profit amounts differ between accrual basis and cash basis because _explain here_ CASH BASIS: Revenue Counselor salary expense Supplies expense Utilities, horses, food Profits Season March April June July August ACCRUAL BASIS: Revenue Counselor salary expense Supplies expense Utilities, horses, food Profits At lower levels (20 campers), you can repay the bus loan ___give estimated time Interval here assuming you dedicate all the cash flow from the summer camp to the loan, without accounting for interest costs or changes in vendor pricing or staff salaries. While this is below the bank's 24-month repayment span, you might give the bank assurance by (put your ideas

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started