Question

You will make marketing recommendations for three hypothetical farmers who want to sell corn, soybeans and cattle as described below. For each recommendation, you need

You will make marketing recommendations for three hypothetical farmers who want to sell corn, soybeans and cattle as described below. For each recommendation, you need to provide the following information.

- Your expectations for futures prices and basis in the coming months. Here you need to indicate what you expect to happen with futures prices and basis and briefly explain the rationale behind your expectation.

- As you check the news for information about prices, remember to focus on the states and countries that are more relevant for each market (remember the data that you collected for Part # 2).

- The quantity that you recommend selling with futures contracts and/or forward contracts (if any). You can choose to use only one type of contract, both contracts, or neither.

- The justification of your recommendations based on (a) your expectations for futures prices and basis and (b) the characteristics of the marketing strategies available.

- For example, I expect that the futures price will increase and the basis will narrow, therefore I recommend selling so many bushels with a futures (or forward) contract because this contract allows the farmer to.......

- The risk-return profile of your recommendation, i.e. how much risk the farmer is taking and how much return the farmer can potentially obtain.

Therefore, your answer needs to contain the four points above for each marketing recommendation for Farmer A, Farmer B and Farmer C below.

There is no "right" or "wrong" recommendation here and your answer will be graded based on:

- completing all requirements above,

- the consistency of the justification for the recommendations (i.e. regardless what recommendation you come up with, it needs to make sense), and

- the consistency of the risk-return profile (i.e. it needs to be consistent with your choice of marketing strategy).

Farmer A (corn)

This farmer in Emerald, NE is planning to harvest 50,000 bushels of corn in the fall, and she estimates her break-even price is $4.55/bu (this includes her cost of production and also some extra funds she needs to pay bills and invest in the farm). She is trying to decide whether she should:

- sell all bushels now with futures contracts and/or forward contracts,

- sell a portion of the bushels now with futures contracts and/or forward contracts, and the remaining bushels later, or

- sell nothing now.

She wants to deliver her grain sometime in November, and the grain elevator in her local cash market is offering a forward contract for November 2021 delivery at $4.56/bu. If she prefers to use the futures market, she can hedge her grain with the corn futures contract for December 2021 delivery, which is trading at $4.98/bu. The size of the futures contract is 5,000 bushels and initial margin is $1,650/contract (which is the same as the maintenance margin).

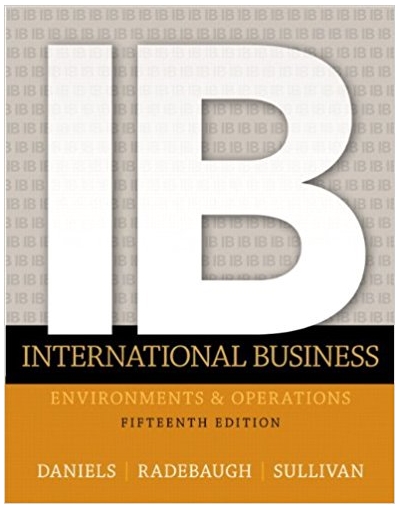

As a reference, the chart below shows the behavior of the corn futures price for December 2021 delivery since the beginning of the year until today (April 12), while the following table shows the average weekly basis in November in her local cash market in the last 7 years.

Corn basis in Emerald, NE in November: 2014 – 2020

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

1st week | –0.4925 | –0.3750 | –0.5125 | –0.5625 | –0.4925 | –0.2875 | -0.3225 |

2nd week | –0.5075 | –0.3625 | –0.4775 | –0.5625 | –0.4700 | –0.2925 | -0.2925 |

3rd week | –0.4925 | –0.3075 | –0.5050 | –0.5425 | –0.4575 | –0.2875 | -0.2675 |

4th week | –0.4525 | –0.3100 | –0.4875 | –0.4663 | –0.4350 | –0.2775 | -0.2700 |

Farmer B (soybeans)

This farmer in Emerald, NE is planning to harvest 65,000 bushels of soybeans in the fall, and he estimates his break-even price is $9.85/bu (this includes his cost of production and also some extra funds she needs to pay bills and invest in the farm). He is trying to decide whether he should:

- sell all bushels now with futures contracts and/or forward contracts,

- sell a portion of the bushels now with futures contracts and/or forward contracts, and the remaining bushels later, or

- sell nothing now.

He wants to deliver his grain sometime in November, and the grain elevator in his local cash market is offering a forward contract for November 2021 delivery at $11.82/bu. If he prefers to use the futures market, he can hedge his grain with the soybean futures contract for November 2021 delivery, which is trading at $12.54/bu. The size of the futures contract is 5,000 bushels and initial margin is $3,685/contract (which is the same as the maintenance margin).

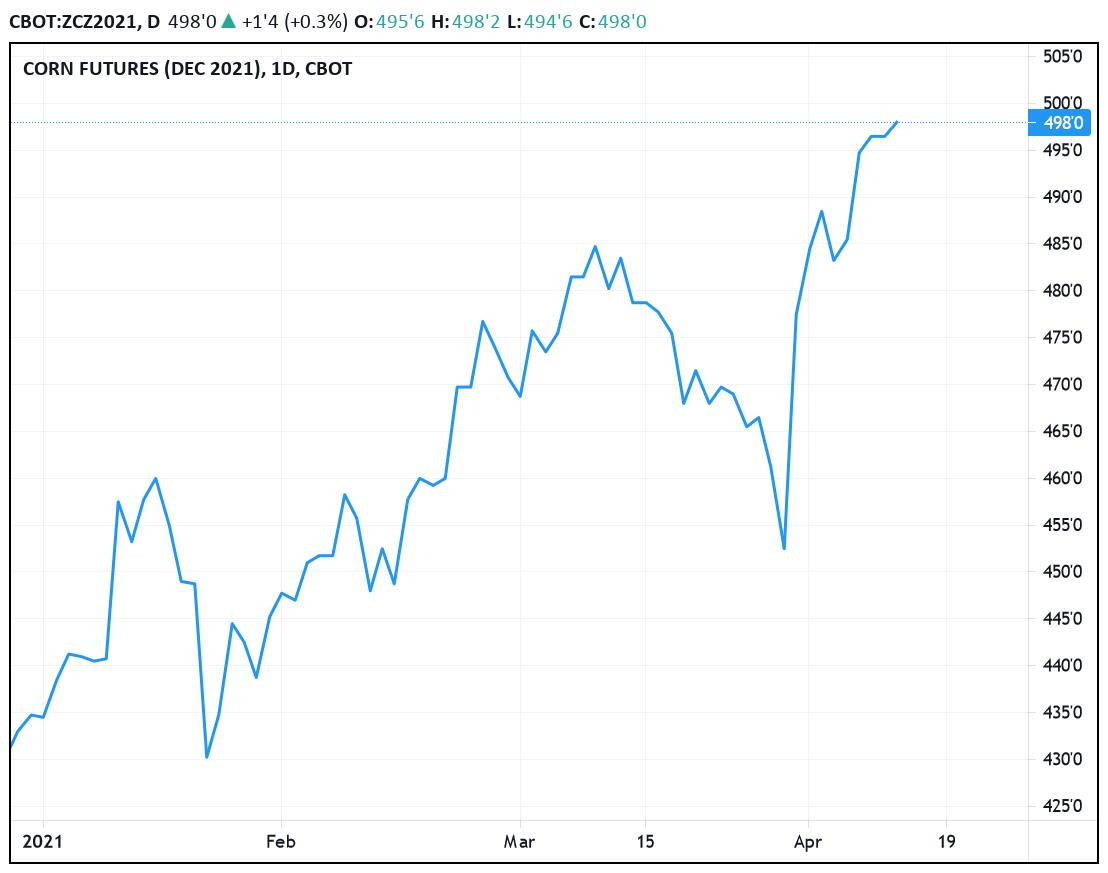

As a reference, the chart below shows the behavior of the soybean futures price for November 2021 delivery since the beginning of the year until today (April 12), while the following table shows the average weekly basis in November in her local cash market in the last 7 years.

Soybean basis in Emerald, NE in November: 2014 – 2020

2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

1st week | –0.8325 | –0.7200 | –1.0050 | –1.1225 | –1.1550 | –1.0450 | -0.6825 |

2nd week | –0.8275 | –0.6975 | –0.8100 | –1.1150 | –1.1750 | –1.0225 | -0.6750 |

3rd week | –0.7775 | –0.5975 | –1.0075 | –1.0825 | –1.0500 | –1.0000 | -0.6800 |

4th week | –0.7800 | –0.6025 | –0.9725 | –0.9988 | –1.0550 | –0.9200 | -0.6800 |

Farmer C (cattle)

This farmer in Nebraska is feeding livestock and plans to have 100 heads of steers ready for market at the end of August. She estimates a final weight of 1,100 pounds, so the total quantity to be sold would amount to 110,000 pounds of cattle. She also estimates her break-even price at $1.2350/lb and she is now trying to decide whether she should:

- sell everything now with futures contracts and/or forward contracts,

- sell a portion now with futures contracts and/or forward contracts, and the remaining later, or

- sell nothing now.

A packer (buyer) is offering to buy all 100 heads with a forward contract for August delivery at $1.2200/lb. If she prefers to use the futures market, she can hedge her cattle with the live cattle futures contract for August 2021 delivery, which is trading at $1.2195/lb. The size of the futures contract is 40,000 pounds and initial margin is $1,760/contract (which is the same as the maintenance margin).

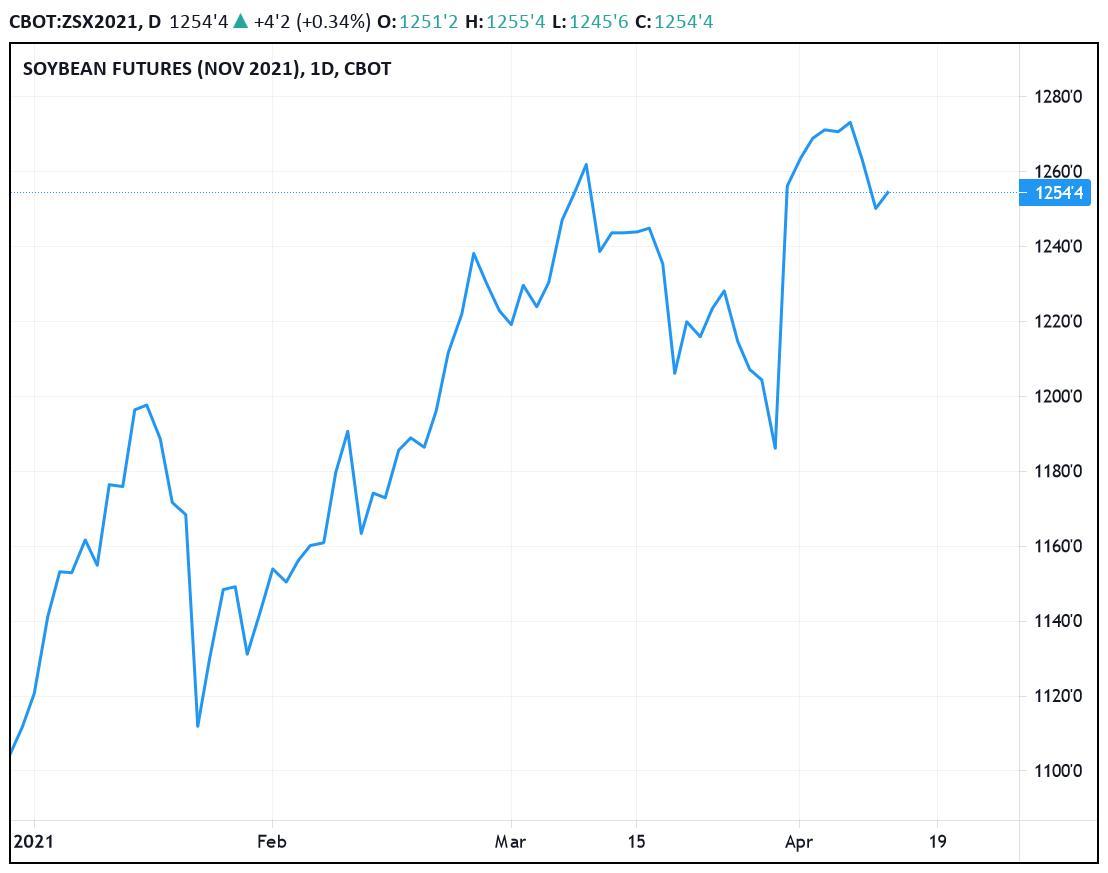

As a reference, the chart below shows the behavior of the live cattle futures price for August 2021 delivery since the beginning of the year until today (April 12). Besides, historically, the basis in her local cash market in August has ranged between +$0.0100/lb and +$0.0250/lb.

CBOT:ZCZ2021, D 498'0 A +1'4 (+0.3%) O:495'6 H:498'2 L:494'6 C:498'0 505'0 CORN FUTURES (DEC 2021), 1D, CBOT 500'0 498'0 495'0 490'0 485'0 480'0 475'0 470'0 465'0 460'0 455'0 450'0 445'0 440'0 435'0 430'0 425'0 2021 Feb Mar 15 Apr 19

Step by Step Solution

3.31 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

This farmer in Emerald NE is planning to harvest 50000 bushels of corn in the fall and she estimates ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started