Question

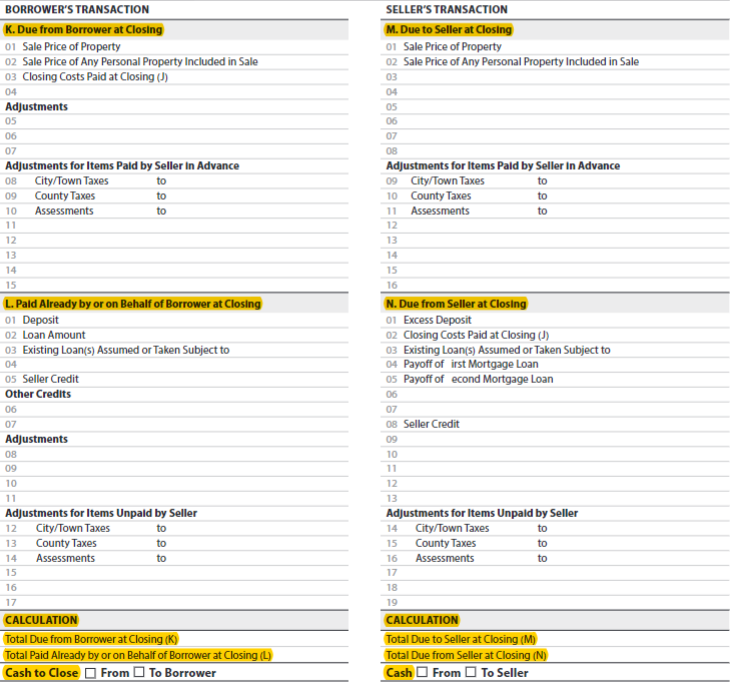

You will need to complete Page 3 of the Closing Disclosure for Module 15. You should upload your completed Page 3 of the closing disclosure.

You will need to complete Page 3 of the Closing Disclosure for Module 15. You should upload your completed Page 3 of the closing disclosure. Each student needs to complete their own form.

A buyer is purchasing a home for $200,000. The closing date is on June 15, 2023 and the buyer is responsible for all costs on the closing date. The buyer provided $5,000 as a deposit that is being held in escrow and is obtaining a loan for $180,000. The seller has a mortgage on the property with an outstanding balance of $92,000. Total settlement charges for the buyer is $7,200 and for the seller is $12,000. The county taxes for 2022 are due on November 1 and have not been paid. The total county tax amount due for the year is $4,380. The home inspection report indicated the A/C unit will need repaired and the seller has agreed to provide a $1,000 credit to the buyer, which the lender has approved. Use Page 3 of the closing disclosure to account for the information above and upload this page to be graded. There should be 21 numbers on this page and each number will count for one point with the opportunity for one extra credit point.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started