Question

You will take on the role of accountant for Platinum Pty Ltd. Platinum Pty Ltd specialises in the production of specialist components for cars, trucks

You will take on the role of accountant for Platinum Pty Ltd. Platinum Pty Ltd specialises in the production of specialist components for cars, trucks and other land vehicles. These components are constructed from steel, which Platinum purchases in and then either (a) sells on to end customers (car manufacturers) or (b) uses to construct its components.

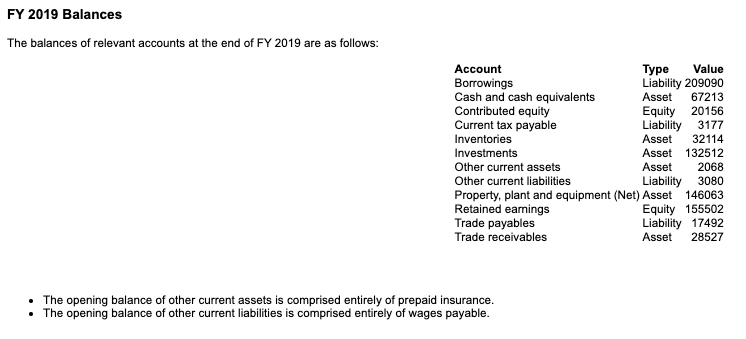

The company has been operating successfully to the end of FY 2019. It is now time to prepare the FY 2020 financial statements. You have been provided the information below.

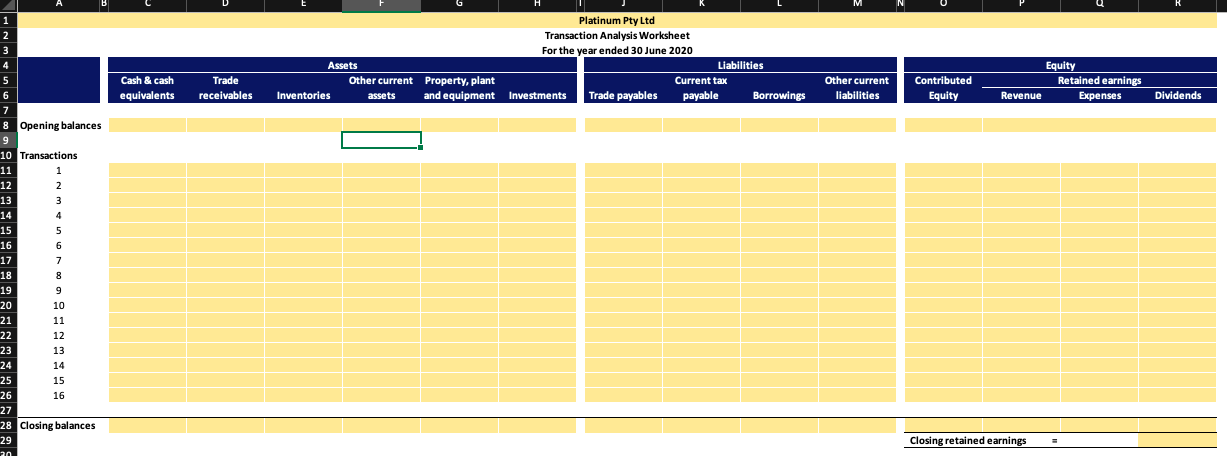

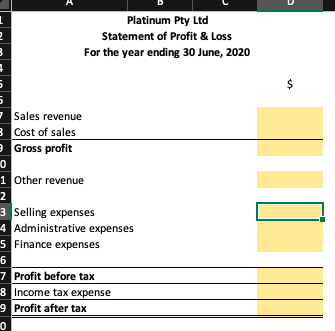

Your task is to prepare the financial statements for FY 2020. Specifically, you are tasked with preparing:

-

A transaction analysis for the FY 2020;

-

A Statement of Profit & Loss for the FY 2020;

FY 2020 Transaction data

A summary of the transactions entered into by the company in FY 2020 are as follows:

| # | Transaction |

|---|---|

| 1 | During the year, Platinum Pty Ltd repays $41818 of its bank debt. The remaining borrowings are to be repaid over the following ten years. On the borrowings of Platinum Pty Ltd, during the year the bank charged Platinum Pty Ltd $14636 in interest. This amount was directly charged to the bank account of the company. |

| 2 | During the year Platinum Pty Ltd makes $34000 in sales on credit terms of 30 days. These sales were carried in inventory at a value of $6800. |

| 3 | During the year, the accountants at Platinum Pty Ltd determine that depreciation should be recorded at $14606. They estimate that 20% of the depreciation is related to selling activities, with the remaining related to administration. |

| 4 | By the end of the year, Platinum Pty Ltd collects from its debtors a total of $38714. |

| 5 | At the start of the year, Platinum Pty Ltd extended its lease on its premises for 12 months. Each month of rent costs $1000, and the company pays its rent on a monthly basis by direct debit to its bank account. |

| 6 | During the year, Platinum Pty Ltd purchased $32000 of inventory from its suppliers of raw materials. The inventory was purchased on credit. |

| 7 | During the year, Platinum Pty Ltd purchased an additional $17000 of computer equipment. Half the amount was paid in cash, with the remaining half on credit. The accountant determines that the credit amount should be allocated to other current liabilities. |

| 8 | During the year, Platinum Pty Ltd incurred $15506 of wages costs. The company has paid this amount in full by the end of the year. In addition, the company also paid all wages owing from previous years. |

| 9 | By the end of the year, Platinum Pty Ltd pays off $19003 of debts owing to its trade creditors. |

| 10 | During the year Platinum Pty Ltd issues 34000 shares to a new investors. These shares are issued at an average price of $2 per share. |

| 11 | At the end of the year, Platinum Pty Ltd declares and pays a $17267 dividend to its shareholders. |

| 12 | During the year, Platinum Pty Ltd also purchased $32000 of inventory in cash from its suppliers of higher value add material. |

| 13 | By the end of the year, Platinum Pty Ltd uses up the remainder of its previous insurance contract that was prepaid in the previous year. Halfway into the year, the company signs a new contract for the next twelve months of insurance, paying, $19200 upfront. |

| 14 | Platinum Pty Ltd has paid all of its company income tax owing from the previous period. In addition, the company incurs a further $21980 in corporate income tax that it will pay next year. |

| 15 | During the year Platinum Pty Ltd receives a royalty payment of $77213. |

| 16 | During the year Platinum Pty Ltd makes a sale of $56000. Of this amount, 40% was paid in cash with the remainder on credit terms of 60 days. The inventory for this sale was carried at a value of $11200. |

* Borrowings are to be repaid equally over the relevant term.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started