Question

You will use the provided financial statements for Starbucks. Take 2019 and 2020 information given and perform the required financial ratios listed below. Compare the

You will use the provided financial statements for Starbucks. Take 2019 and 2020 information given and perform the required financial ratios listed below. Compare the ratios of 2019 and 2020 to each other. In comparing the ratios you will need to discuss which year has a better ratio, justify your rationale, and explain your findings in detail in your analysis.

Part 1:

1) What is the ratio used for, what is its’ purpose?

2) Write out formula

3) Fill out formula using the two years financial statement information for both companies

Part 2: For each of the four categories of ratios, identify what the four categories are, and in your own words, explain the following

1) Who are the main stakeholders?

2) What are they assessing?

3) Why are they assessing it?

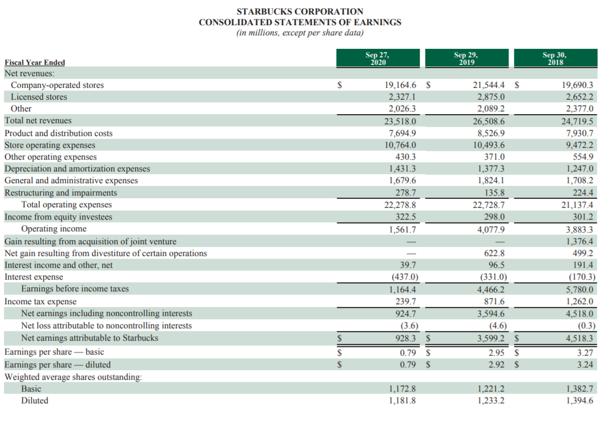

STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, except per share data) Sep 27, 2020 Eiscal Year Endol Net revenues: Company-operated stores Licensed stores Other Total net revenues Product and distribution costs Store operating expenses Other operating expenses Depreciation and amortization expenses General and administrative expenses Restructuring and impairments Total operating expenses Income from equity investees Operating income Gain resulting from acquisition of joint venture Net gain resulting from divestiture of certain operations Interest income and other, net Interest expense Earnings before income taxes Income tax expense Net earnings including noncontrolling interests Net loss attributable to noncontrolling interests Net camnings attributable to Starbucks Earnings per share-basic Earnings per share-diluted Weighted average shares outstanding Basic Diluted viss 19,164.6 S 2,327.1 2,026.3 23,518.0 7,694,9 10,764.0 430.3 1,431.3 1,679,6 278.7 22,278.8 322.5 1,561.7 39.7 (437.0) 1,164.4 239.7 924.7 (3.6) 928.3 S 0.79 S 0.79 S 1,172.8 1,181.8 Sep 29, 2019 21,544.4 S 2,875.0 2,089.2 26,508.6 8,526.9 10,493.6 371.0 1,377.3 1,824.1 135.8 22,728.7 298.0 4,077.9 622.8 96.5 (331.0) 4,466.2 871.6 3,594.6 3,599.2 2.95 S 2.92 $ (4.6) 1,221.2 1,233.2 Sep 30, 2018 19,690.3 2,652.2 2,377.0 24,719,5 7,930.7 9.472.2 554.9 1,247.0 1,708.2 224.4 21,137.4 301.2 3,883.3 1,376.4 499.2 191.4 (170.3) 5,780.0 1,262.0 4,518.0 (0.3) 4,518.3 3.27 3.24 1,382.7 1,394.6

Step by Step Solution

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

2020 2019 Liquidity Ratios Under This Section ratios are Calculated to determine whether the company ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started