Question

You work as a pensions actuary for consultancy ActyBen. One of ActyBens major clients is multinational employer GDOI who sponsors two pension schemes for UK

You work as a pensions actuary for consultancy ActyBen. One of ActyBen's major clients is multinational employer GDOI who sponsors two pension schemes for UK employees. Both schemes operate under trust arrangements. All new employees since 1 January 2020 have been automatically enrolled into the growing GDOI DC Pension Scheme; while employees who joined earlier are members of the GDOI FS Pension Scheme. The FS scheme is closed to new entrants, however existing members continue to accrue benefits and there are no plans to alter this arrangement. The latest available information about the schemes is as follows:

Final Salary Scheme

| Number of members | Actuarial Liability | |

| Active members | 540 | |

| Deferred members | 1,130 | |

| Pensioners | 630 | |

| TOTAL MEMBERS | 2,300 | £402,000,000 |

| Total assets under management | £390,000,000 | |

| Total contributions in the previous 12 months | £4,000,000 |

Defined Contribution Scheme

| Number of members | 290 |

| Total of members' account balances | £1,300,000 |

| Total Salaries | £9,570,000 |

| Total contributions in previous 12 months | £750,000 |

Question:

In the GDOI DC scheme, members must contribute at least 5% of salary. They may choose to contribute more, up to a maximum of 15% of salary. GDOI match the member's first 5% contribution, then will match half of any excess contributions. So for a member contributing 10%, GDOI will contribute 7.5%, and for a member contributing 15%, GDOI will contribute 10% of salary. GDOI management are concerned that contribution levels to the DC scheme are low, with most members paying only the minimum 5%. You have been asked to make a simple interactive ready reckoner which will help employees understand the impact of making further contributions to their retirement benefits. Your projections will be based on the scheme rules, so should incorporate appropriate levels of employer contribution for the given member rate.

Ready reckoner must include at least the following:

- Indicative outcomes for a member's projected account balance over a period of both 10 and 20 years,

- dependent on at least 3 contribution levels,

- along with an indication of the gross replacement rate that the individual can expect to receive from those contributions assuming they are age 65 at the end of the period. You should assume that the member buys a lifetime annuity using the full value of their accumulated DC balance when they reach age 65, and that the annuity price is calculated on the basis given below. It may help to remember that the value of the lifetime annuity will be the same in all cases.

*A ready reckoner may be:

- A computer programme which calculates values, which may be presented as (for example) an online calculator or app; or

- A table of pre-calculated values often multiples of given amounts, which may be presented as (for example) a printed book; a table; a slide calculator or disc calculator.

1 Fully functional interactive ready reckoner in format determined by you. The ready reckoner MUST be self-explanatory for the user. Both physical and computer-based reckoners must incorporate basic instructions for use, and guide to interpret the results, including any sensible caveats. These must not be in a separate document. The format may be as creative as you like; and must involve some form of interaction by the user (so a link to the spreadsheet page or printout of the spreadsheet results would score ZERO for the reckoner itself, with a separate score for the calculations themselves as explained below).

2. Brief guide addressed to the Pensions Manager at GDOI, explaining the design of the reckoner, what it illustrates to scheme members, and the reasons you have selected this format. You should also discuss the approach taken to the underlying calculations and the assumptions you have made, any limitations of the design or assumptions, plus identify any opportunities to develop this idea further at a later stage.

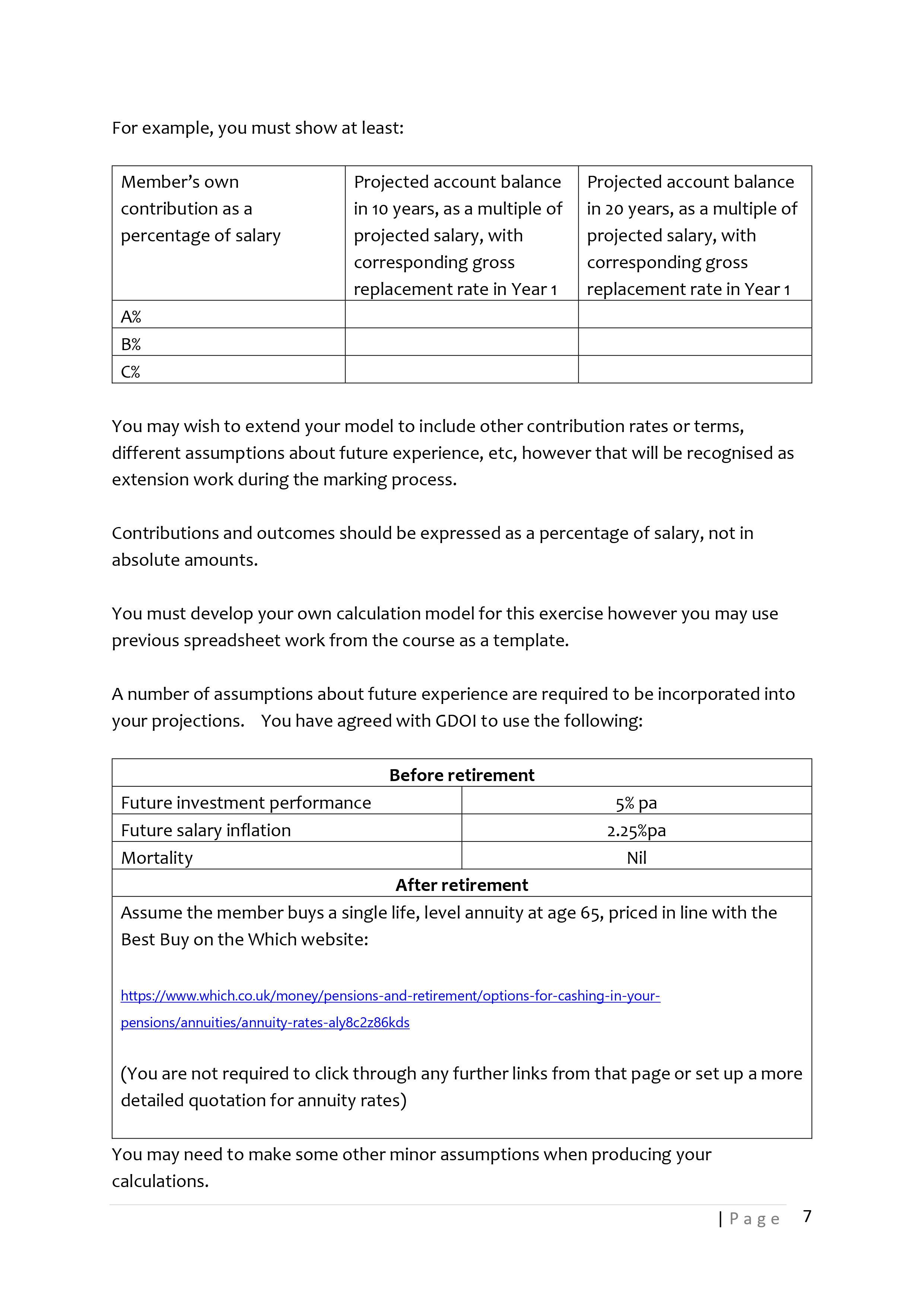

For example, you must show at least: Member's own contribution as a percentage of salary A% B% C% Projected account balance in 10 years, as a multiple of projected salary, with corresponding gross replacement rate in Year 1 You may wish to extend your model to include other contribution rates or terms, different assumptions about future experience, etc, however that will be recognised as extension work during the marking process. Contributions and outcomes should be expressed as a percentage of salary, not in absolute amounts. Projected account balance in 20 years, as a multiple of projected salary, with corresponding gross replacement rate in Year 1 You must develop your own calculation model for this exercise however you may use previous spreadsheet work from the course as a template. A number of assumptions about future experience are required to be incorporated into your projections. You have agreed with GDOI to use the following: Future investment performance Future salary inflation Mortality Before retirement 5% pa 2.25%pa Nil After retirement Assume the member buys a single life, level annuity at age 65, priced in line with the Best Buy on the Which website: pensions/annuities/annuity-rates-aly8c2z86kds https://www.which.co.uk/money/pensions-and-retirement/options-for-cashing-in-your- (You are not required to click through any further links from that page or set up a more detailed quotation for annuity rates) You may need to make some other minor assumptions when producing your calculations. | Page 7

Step by Step Solution

3.34 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Dear Pensions Manager at GDOI I have developed a ready reckoner to address the concern regarding low contribution levels to the GDOI DC Pension Scheme The ready reckoner is designed to help scheme mem...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started