Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work as a sales manager in Aeon's Women's Clothing Department. You were asked to prepare a budgeted income statement for the department for

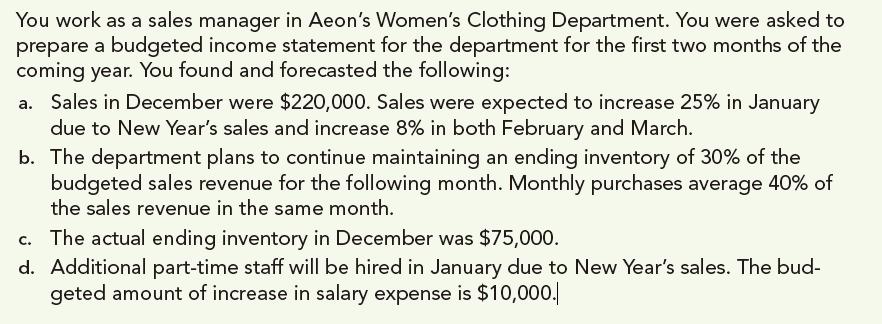

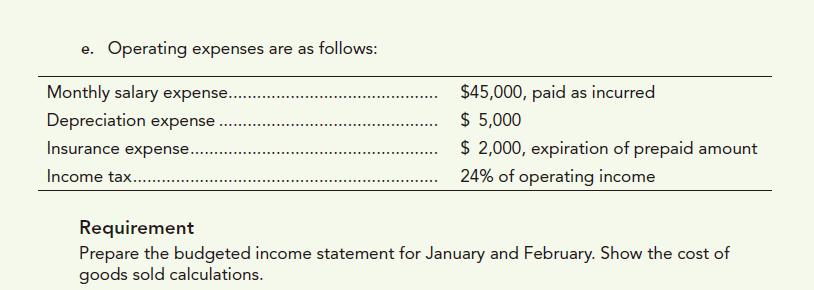

You work as a sales manager in Aeon's Women's Clothing Department. You were asked to prepare a budgeted income statement for the department for the first two months of the coming year. You found and forecasted the following: a. Sales in December were $220,000. Sales were expected to increase 25% in January due to New Year's sales and increase 8% in both February and March. b. The department plans to continue maintaining an ending inventory of 30% of the budgeted sales revenue for the following month. Monthly purchases average 40% of the sales revenue in the same month. c. The actual ending inventory in December was $75,000. d. Additional part-time staff will be hired in January due to New Year's sales. The bud- geted amount of increase in salary expense is $10,000. e. Operating expenses are as follows: Monthly salary expense.... Depreciation expense. Insurance expense..... Income tax......... **** $45,000, paid as incurred $5,000 $ 2,000, expiration of prepaid amount 24% of operating income Requirement Prepare the budgeted income statement for January and February. Show the cost of goods sold calculations.

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the budgeted income statement for January and February for Aeons Womens Clothing Department we will need to calculate several figures based on the provided information Lets start by breakin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started