Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work at an investment bank which is hired by a potential buyer to evaluate the following transaction: The owner of a small factory

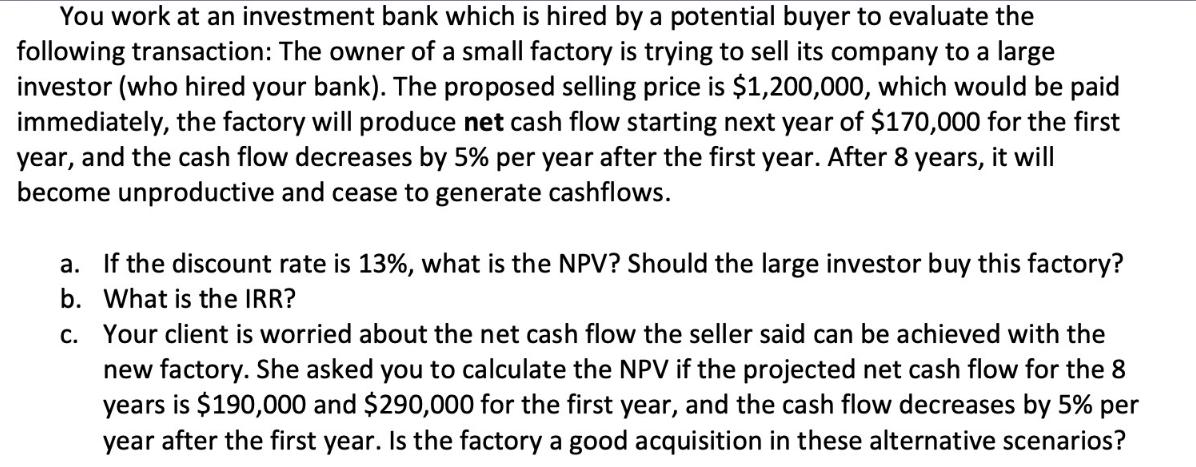

You work at an investment bank which is hired by a potential buyer to evaluate the following transaction: The owner of a small factory is trying to sell its company to a large investor (who hired your bank). The proposed selling price is $1,200,000, which would be paid immediately, the factory will produce net cash flow starting next year of $170,000 for the first year, and the cash flow decreases by 5% per year after the first year. After 8 years, it will become unproductive and cease to generate cashflows. a. If the discount rate is 13%, what is the NPV? Should the large investor buy this factory? b. What is the IRR? C. Your client is worried about the net cash flow the seller said can be achieved with the new factory. She asked you to calculate the NPV if the projected net cash flow for the 8 years is $190,000 and $290,000 for the first year, and the cash flow decreases by 5% per year after the first year. Is the factory a good acquisition in these alternative scenarios?

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate the transaction and answer the questions we need to calculate the Net Present Value NPV and Internal Rate of Return IRR for the given cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started