Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work for a firm whose home currency is the South Korean Won (KRW) and that is considering a foreign investment based in Spain. The

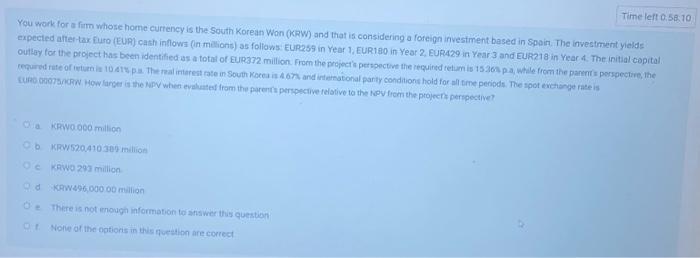

You work for a firm whose home currency is the South Korean Won (KRW) and that is considering a foreign investment based in Spain. The investment yields expected after-tax Euro (EUR) cash inflows (in millions) as follows: EUR259 in Year 1, EUR180 in Year 2, EUR429 in Year 3 and EUR218 in Year 4. The initial capital outlay for the project has been identified as a total of EUR372 million. From the project's perspective the required return is 15.36% p.a, while from the parent's perspective, the required rate of return is 10.41% p.a. The real interest rate in South Korea is 4.67% and international parity conditions hold for all time periods. The spot exchange rate is EURO.00075/KRW. How larger is the NPV when evaluated from the parent's perspective relative to the NPV from the project's perspective? O a. KRW0.000 million O b. KRW520,410.389 million Oc. KRW0.293 million O d. -KRW496,000.00 million Oe. Of. There is not enough information to answer this question None of the options in this question are correct Time left 0:58:10 4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started