Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You work for a large fish-processing corporation in Newfoundland. The company is considering using a new automated packaging technology to speed up and eliminate waste

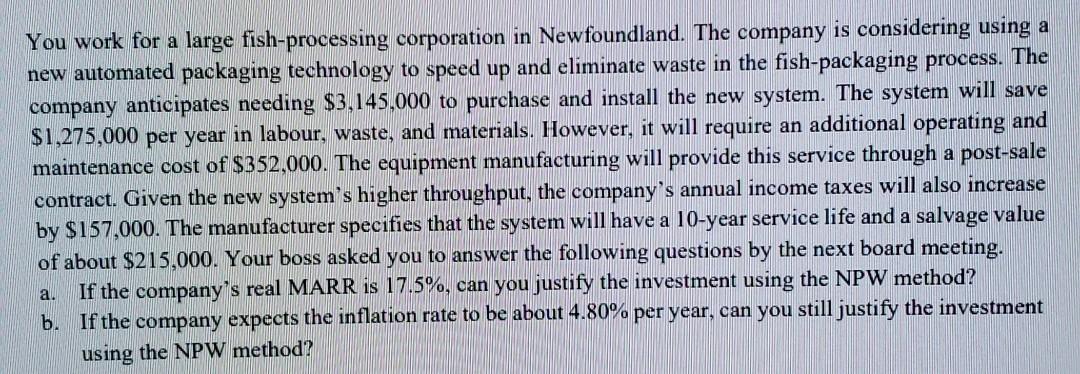

You work for a large fish-processing corporation in Newfoundland. The company is considering using a new automated packaging technology to speed up and eliminate waste in the fish-packaging process. The company anticipates needing $3,145,000 to purchase and install the new system. The system will save $1,275,000 per year in labour, waste, and materials. However, it will require an additional operating and maintenance cost of $352,000. The equipment manufacturing will provide this service through a post-sale contract. Given the new system's higher throughput, the company's annual income taxes will also increase by $157,000. The manufacturer specifies that the system will have a 10-year service life and a salvage value of about $215,000. Your boss asked you to answer the following questions by the next board meeting. a. If the company's real MARR is 17.5%, can you justify the investment using the NPW method? b. If the company expects the inflation rate to be about 4.80% per year, can you still justify the investment using the NPW method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started