Answered step by step

Verified Expert Solution

Question

1 Approved Answer

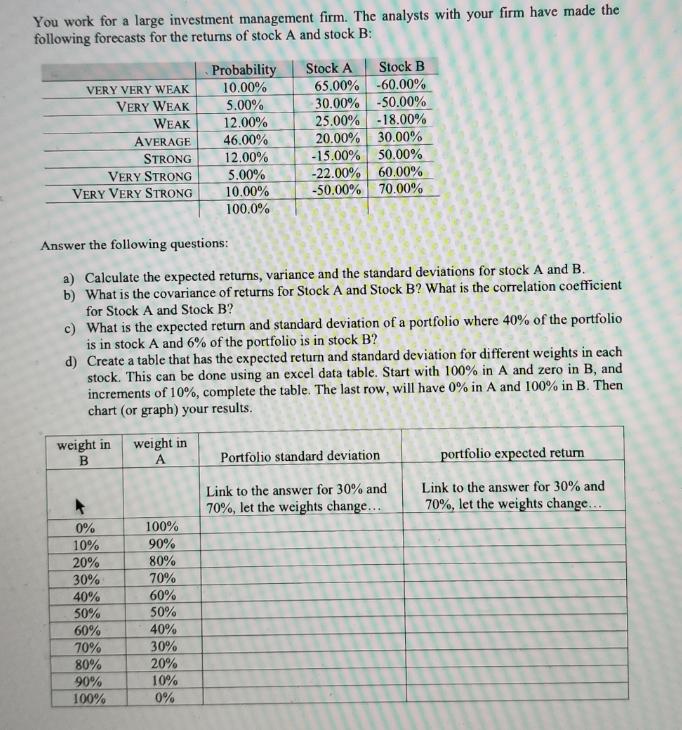

You work for a large investment management firm. The analysts with your firm have made the following forecasts for the returns of stock A

You work for a large investment management firm. The analysts with your firm have made the following forecasts for the returns of stock A and stock B: VERY VERY WEAK VERY WEAK WEAK AVERAGE STRONG VERY STRONG VERY VERY STRONG weight in B 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% Answer the following questions: a) Calculate the expected returns, variance and the standard deviations for stock A and B. b) What is the covariance of returns for Stock A and Stock B? What is the correlation coefficient for Stock A and Stock B? weight in A Probability 10.00% 5.00% c) What is the expected return and standard deviation of a portfolio where 40% of the portfolio is in stock A and 6% of the portfolio is in stock B? d) Create a table that has the expected return and standard deviation for different weights in each stock. This can be done using an excel data table. Start with 100% in A and zero in B, and increments of 10%, complete the table. The last row, will have 0% in A and 100% in B. Then chart (or graph) your results. 100% 90% 80% 70% 60% 50% 40% 12.00% 46.00% 12.00% 30% 20% 10% 0% 5.00% 10.00% 100.0% Stock B 65.00% -60.00% 30.00% -50.00% 25.00% -18.00% 20.00% 30.00% -15.00% 50.00% -22.00% 60.00% -50.00% 70.00% Stock A Portfolio standard deviation Link to the answer for 30% and 70%, let the weights change... portfolio expected return Link to the answer for 30% and 70%, let the weights change...

Step by Step Solution

★★★★★

3.56 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Stock A expected return 0165 00530 01225 04620 01215 00522 0150 129 Variance of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started