Question

You work for the public accounting (audit) firm of Teper and Lubetsky. You have been approached by Autio Inc. to be its auditor for the

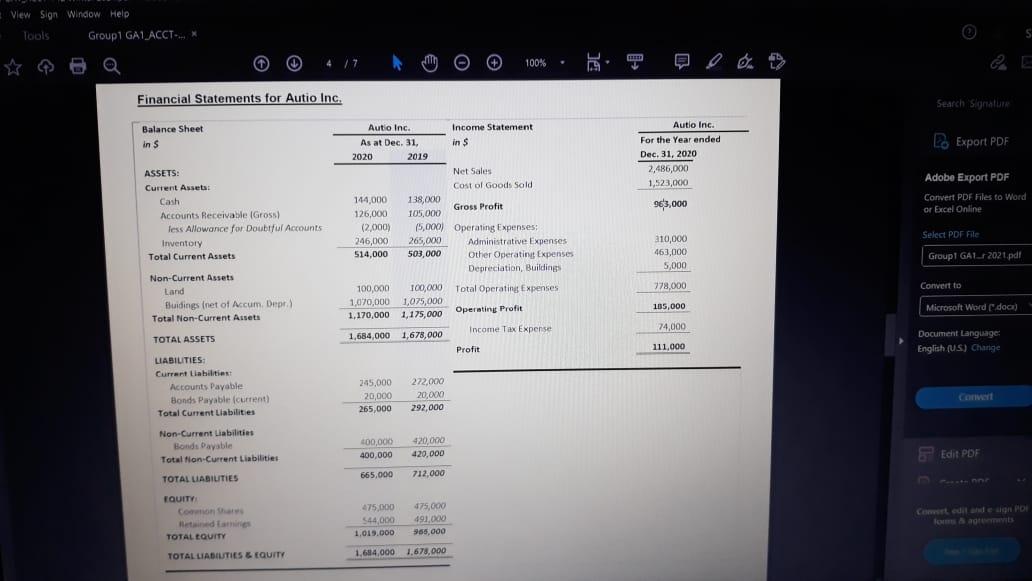

You work for the public accounting (audit) firm of Teper and Lubetsky. You have been approached by Autio Inc. to be its auditor for the 2020 fiscal year. Autio Inc. is a medium sized company operating in Southern Ontario as a merchandise wholesaler, buying goods to sell to retailers. [For this assignment, ignore issues related to communication with prior auditors] You will review the draft financial statements found on the next page as you prepare for audit planning. In addition, upon an inquiry, you discover the following three facts about Autio Inc.: Company management maintains best-in-class business practices such as requiring all business agreements to be clearly documented (for example, with its many suppliers) and has never had even one dispute concerning payments to suppliers. Everyone in the industry is known to appreciate the high ethical standards of the management team. The company has two shareholders, and each of them is intimately knowledgeable of company financial and operating affairs. These two shareholders often speak directly to the Senior Management team. In fact, the holder of all of the companys Bonds (see Liabilities section of the Balance Sheet) is one of these two shareholders. The company continuously changes suppliers of its inventory, including the country of origin and currency of payment. The complexity of accounting for these foreign currency transactions is an inherent feature of the companys financial system. Required: a) Using the three facts discovered upon inquiry (see above), evaluate these facts and come to a decision as to whether Teper and Lubetsky should or should not accept the audit engagement. Justify your decision using the three facts and balancing the Pro and Con arguments. [10 marks] b) Assuming you accept the audit engagement, use the draft 2020 financial statements to evaluate Autio Inc.s: i. Liquidity by calculating the 2020 Current Ratio and Quick Ratio (also known as Acid Test) compared to the industry standard of a Current Ratio of 1.8 : 1 and Quick Ratio of 0.9 : 1. [5 marks] ii. Collectability of the 2020 net Accounts Receivable using 2019 as a reasonable basis. [5 marks] c) Propose and justify a dollar amount for Materiality for this 2020 audit of Autio Inc. (assumes you accept the engagement) using the following bases: i. Rule of Thumb of between 5% - 10% of Operating Profit (i.e. Pre-tax profit) ii. Industry standard of 0.6% of revenues [10 marks total for (c)] Note: Use the following definitions for the purposes of this assignment Current Ratio = Current Assets / Current Liabilities Quick Ratio or Acid Test = (Cash + Net Receivables) / Current Liabilities

Financial Statements for Autio Inc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started