Answered step by step

Verified Expert Solution

Question

1 Approved Answer

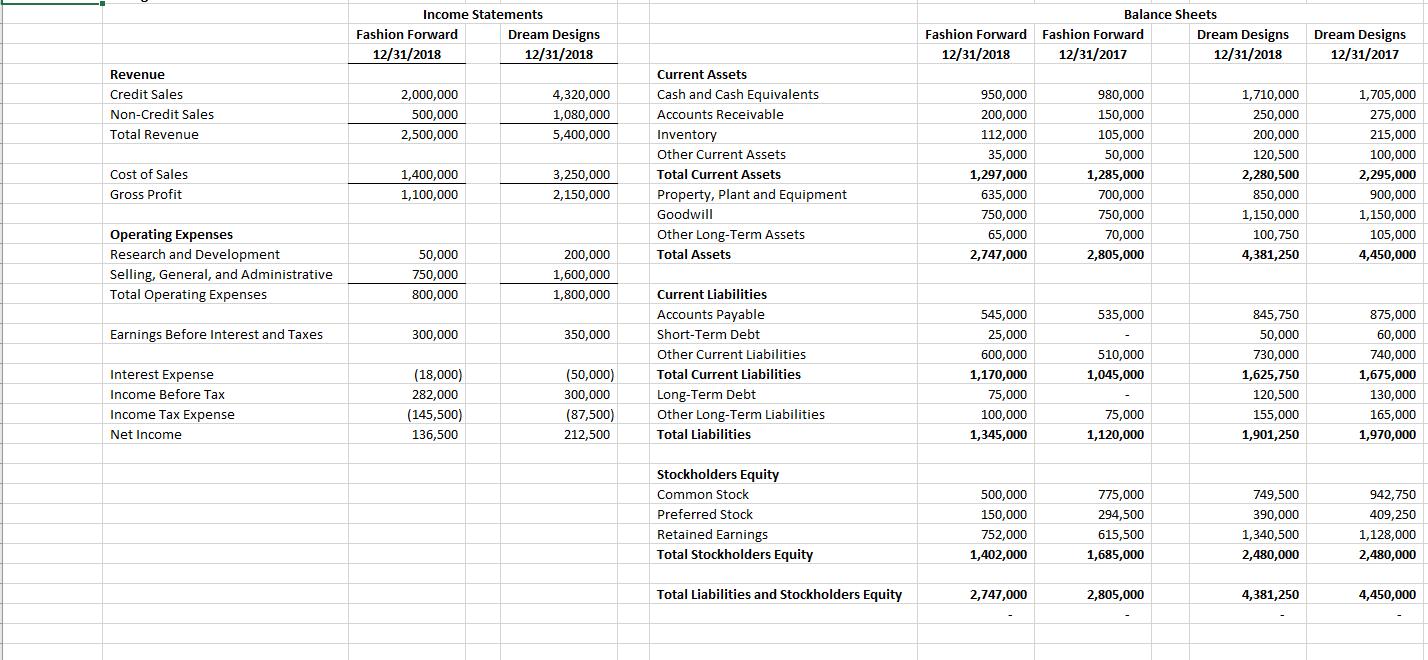

You work in the mergers and acquisitions department of a large conglomerate who is looking to invest in a retail business. Two companies, Fashion Forward

Compute the following ratios for each company:

- Profit Margin Ratio

- Return on Assets

- Current Ratio

- Quick Ratio

- AR Turnover Ratio

- Average Collection Period

- Inventory Turnover Ratio

- Average Sales Period

- Debt to Equity Ratio

For this assignment:

- Compute all required amounts and explain how the computations were performed

- Evaluate the results for each company and explain what each ratio means

- Compare and contrast the companies.

- Based on your analysis:

- recommend which company the organization should pursue

- Thoroughly support your conclusion, including what other factors should be considered

- Be specific.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Profit margin of Fashion is higher as compared to Dream design This could be due to dream design hav...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60618495a746b_55171.pdf

180 KBs PDF File

60618495a746b_55171.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started