Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You worked in Australia's Department of Trade and Industry. The Minister of Trade has asked you to study three proposed FDI projects and report

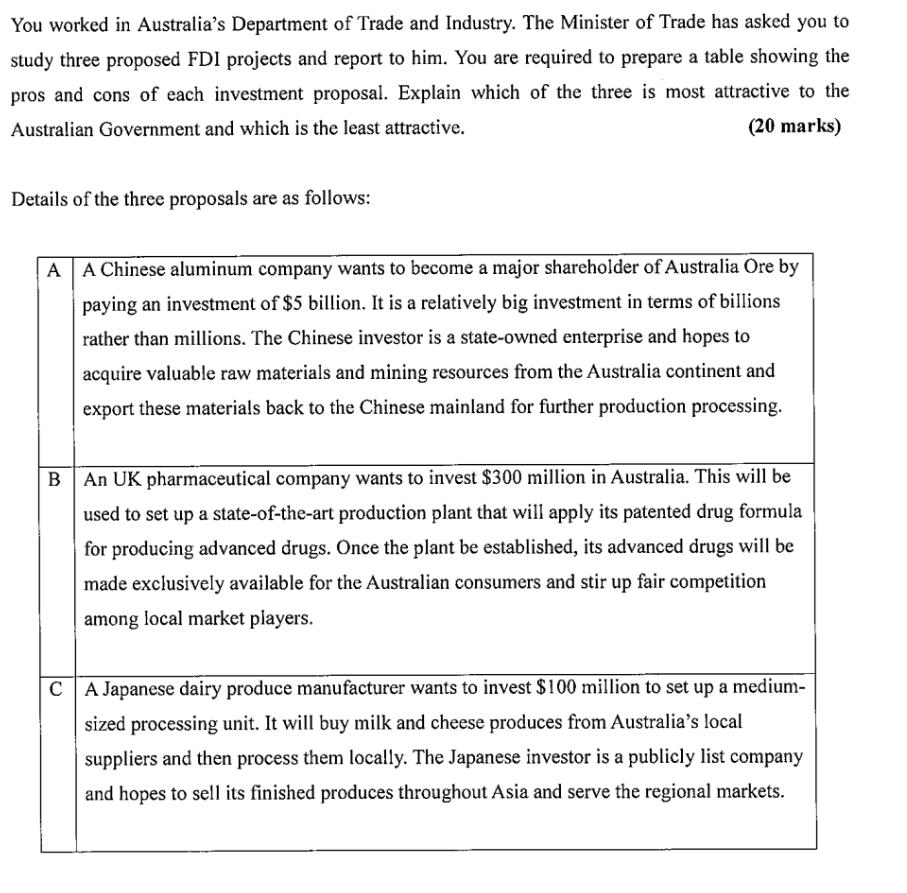

You worked in Australia's Department of Trade and Industry. The Minister of Trade has asked you to study three proposed FDI projects and report to him. You are required to prepare a table showing the pros and cons of each investment proposal. Explain which of the three is most attractive to the Australian Government and which is the least attractive. (20 marks) Details of the three proposals are as follows: A A Chinese aluminum company wants to become a major shareholder of Australia Ore by paying an investment of $5 billion. It is a relatively big investment in terms of billions rather than millions. The Chinese investor is a state-owned enterprise and hopes to acquire valuable raw materials and mining resources from the Australia continent and export these materials back to the Chinese mainland for further production processing. B An UK pharmaceutical company wants to invest $300 million in Australia. This will be used to set up a state-of-the-art production plant that will apply its patented drug formula for producing advanced drugs. Once the plant be established, its advanced drugs will be made exclusively available for the Australian consumers and stir up fair competition among local market players. CA Japanese dairy produce manufacturer wants to invest $100 million to set up a medium- sized processing unit. It will buy milk and cheese produces from Australia's local suppliers and then process them locally. The Japanese investor is a publicly list company and hopes to sell its finished produces throughout Asia and serve the regional markets.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The following table provides a comparison of the pros and cons of each of the three proposed FDI pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started