Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You would like to buy a share of Tesla and a put option on the stock. The put option with an exercise price of

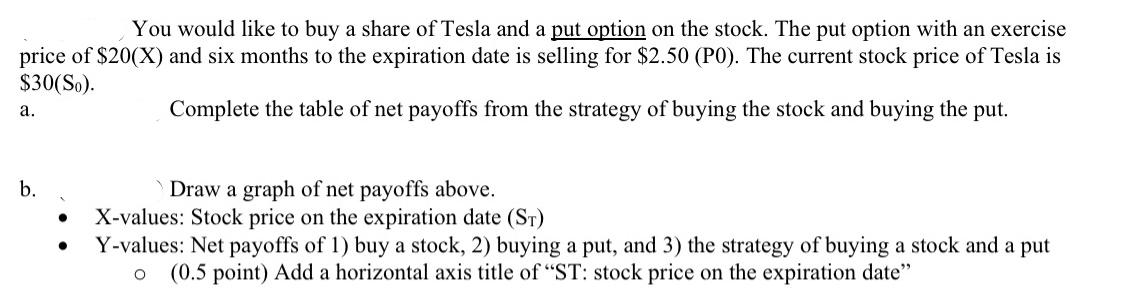

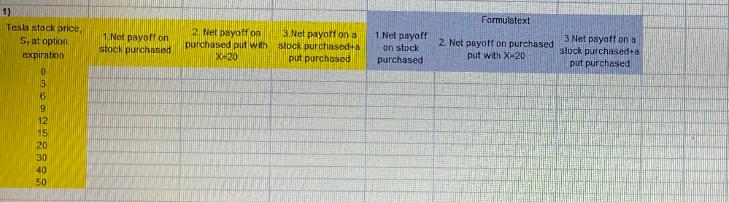

You would like to buy a share of Tesla and a put option on the stock. The put option with an exercise price of $20(X) and six months to the expiration date is selling for $2.50 (PO). The current stock price of Tesla is $30(So). Complete the table of net payoffs from the strategy of buying the stock and buying the put. a. b. Draw a graph of net payoffs above. X-values: Stock price on the expiration date (ST) Y-values: Net payoffs of 1) buy a stock, 2) buying a put, and 3) the strategy of buying a stock and a put O (0.5 point) Add a horizontal axis title of "ST: stock price on the expiration date" e. At what stock price on the expiration date (ST) will you have the zero net payoff from your strategy? (1) Tesla stack price, S, at option expiration 369258898 40 50 1 Net payoff on stock purchased 2. Net payoff on purchased put with X-20 3.Net payoff on a stock purchased a put purchased 1. Net payoff on stock purchased Formulatext 2. Net payoff on purchased put with X-20 3.Net payoff on a stock purchased a put purchased You would like to buy a share of Tesla and a put option on the stock. The put option with an exercise price of $20(X) and six months to the expiration date is selling for $2.50 (PO). The current stock price of Tesla is $30(So). Complete the table of net payoffs from the strategy of buying the stock and buying the put. a. b. Draw a graph of net payoffs above. X-values: Stock price on the expiration date (ST) Y-values: Net payoffs of 1) buy a stock, 2) buying a put, and 3) the strategy of buying a stock and a put O (0.5 point) Add a horizontal axis title of "ST: stock price on the expiration date" e. At what stock price on the expiration date (ST) will you have the zero net payoff from your strategy? (1) Tesla stack price, S, at option expiration 369258898 40 50 1 Net payoff on stock purchased 2. Net payoff on purchased put with X-20 3.Net payoff on a stock purchased a put purchased 1. Net payoff on stock purchased Formulatext 2. Net payoff on purchased put with X-20 3.Net payoff on a stock purchased a put purchased

Step by Step Solution

★★★★★

3.55 Rating (173 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started