Answered step by step

Verified Expert Solution

Question

1 Approved Answer

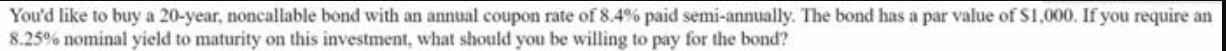

You'd like to buy a 20-year, noncallable bond with an annual coupon rate of 8.4% paid semi-annually. The bond has a par value of

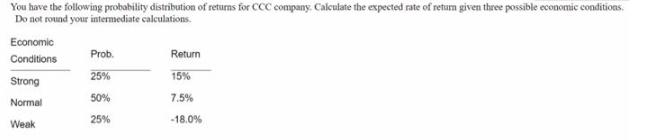

You'd like to buy a 20-year, noncallable bond with an annual coupon rate of 8.4% paid semi-annually. The bond has a par value of $1,000. If you require an 8.25% nominal yield to maturity on this investment, what should you be willing to pay for the bond? You have the following probability distribution of returns for CCC company. Calculate the expected rate of return given three possible economic conditions. Do not round your intermediate calculations. Economic Conditions Prob. Return Strong 25% 15% 50% 7.5% Normal 25% -18.0% Weak

Step by Step Solution

★★★★★

3.50 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

Expected Rate of Return Calculation Expected Return Pro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

663dd6e7b8c75_961749.pdf

180 KBs PDF File

663dd6e7b8c75_961749.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started