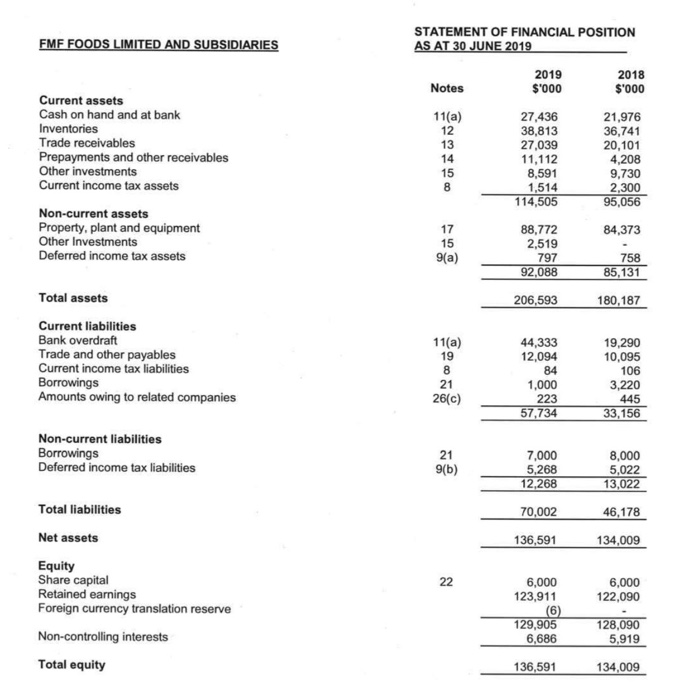

Your analysis will be based on the 2019 annual report for your selected company which include the financial statements (Balance sheet and Income statement). Note we have not covered this topic, but Unit has been opened on moodle. An assignment explanatory video will also be posted on moodle soon. Review the chosen company's financial statements and other relevant information and conduct: a) Horizontal analysis of the Income Statement for 2018 & 2019. b) Vertical analysis of the Balance Sheet for 2018 & 2019. c) Ratio analysis for the comparative periods 2018 & 2019. select any ONE ratio from each of the following ratio categories below that a prospective investor would be most interested in and provide a brief explanation of the significance of each ratio selected from the categories below: o Profitability ratios; o Liquidity ratios; O Financial Stability ratios; O Cash Flow sufficiency ratios and O Cash Flow efficiency ratios. In your analysis give a brief interpretation on the ratios in the comparative period calculated In your conclusion, your analysis should include relevant data to help a prospective investor decide if this company would be a good company to invest all his life-time savings into. FMF FOODS LIMITED AND SUBSIDIARIES STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2019 2019 $'000 2018 $'000 Notes 11(a) Current assets Cash on hand and at bank Inventories Trade receivables Prepayments and other receivables Other investments Current income tax assets 27,436 38,813 27,039 11,112 8,591 1,514 114,505 21,976 36,741 20,101 4,208 9,730 2,300 95,056 Non-current assets Property, plant and equipment Other Investments Deferred income tax assets 84,373 9(a) 88,772 2,519 797 92,088 758 85,131 Total assets 206,593 180,187 11(a) Current liabilities Bank overdraft Trade and other payables Current income tax liabilities Borrowings Amounts owing to related companies 44,333 12,094 84 1,000 223 57,734 19,290 10,095 106 3,220 445 33,156 26(c) Non-current liabilities Borrowings Deferred income tax liabilities 21 7,000 5,268 12.268 8,000 5,022 13,022 Total liabilities 70,002 46,178 Net assets 136,591 134.009 Equity Share capital Retained earnings Foreign currency translation reserve 6,000 122,090 6,000 123,911 (6) 129,905 6,686 Non-controlling interests 128.090 5,919 Total equity 136,591 134,009