Your analysis will include a comparison between the debt level from the base case (i) and those in the sensitivity/scenarios cases. Assignment 3 -

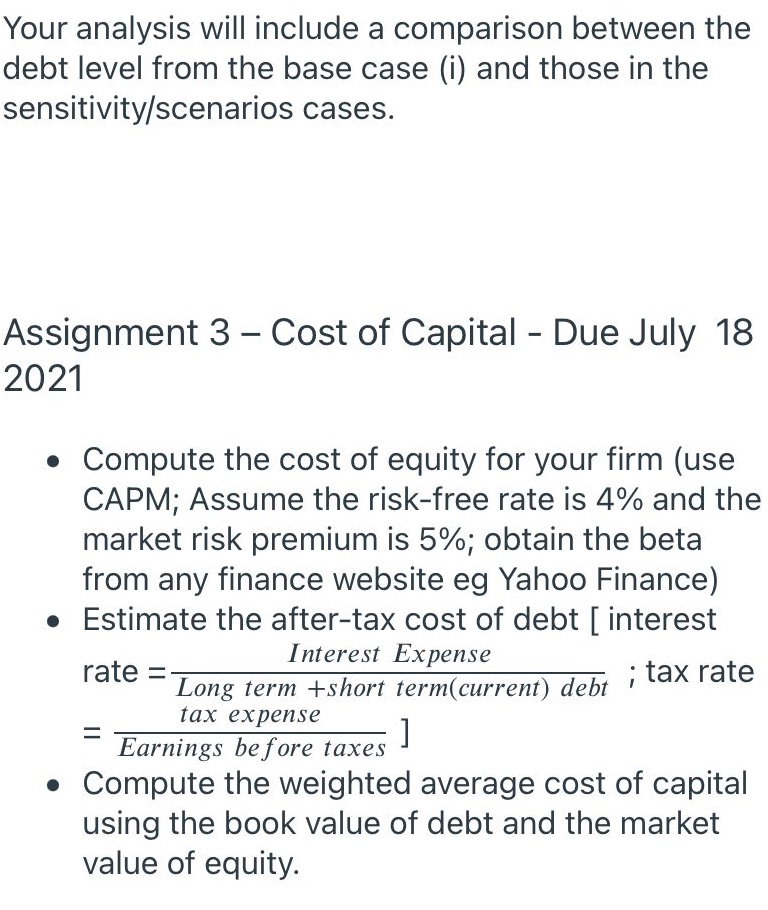

Your analysis will include a comparison between the debt level from the base case (i) and those in the sensitivity/scenarios cases. Assignment 3 - Cost of Capital - Due July 18 2021 Compute the cost of equity for your firm (use CAPM; Assume the risk-free rate is 4% and the market risk premium is 5%; obtain the beta from any finance website eg Yahoo Finance) Estimate the after-tax cost of debt [ interest Interest Expense rate= = Long term +short term(current) debt ; tax rate tax expense Earnings before taxes ] Compute the weighted average cost of capital using the book value of debt and the market value of equity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started