Question

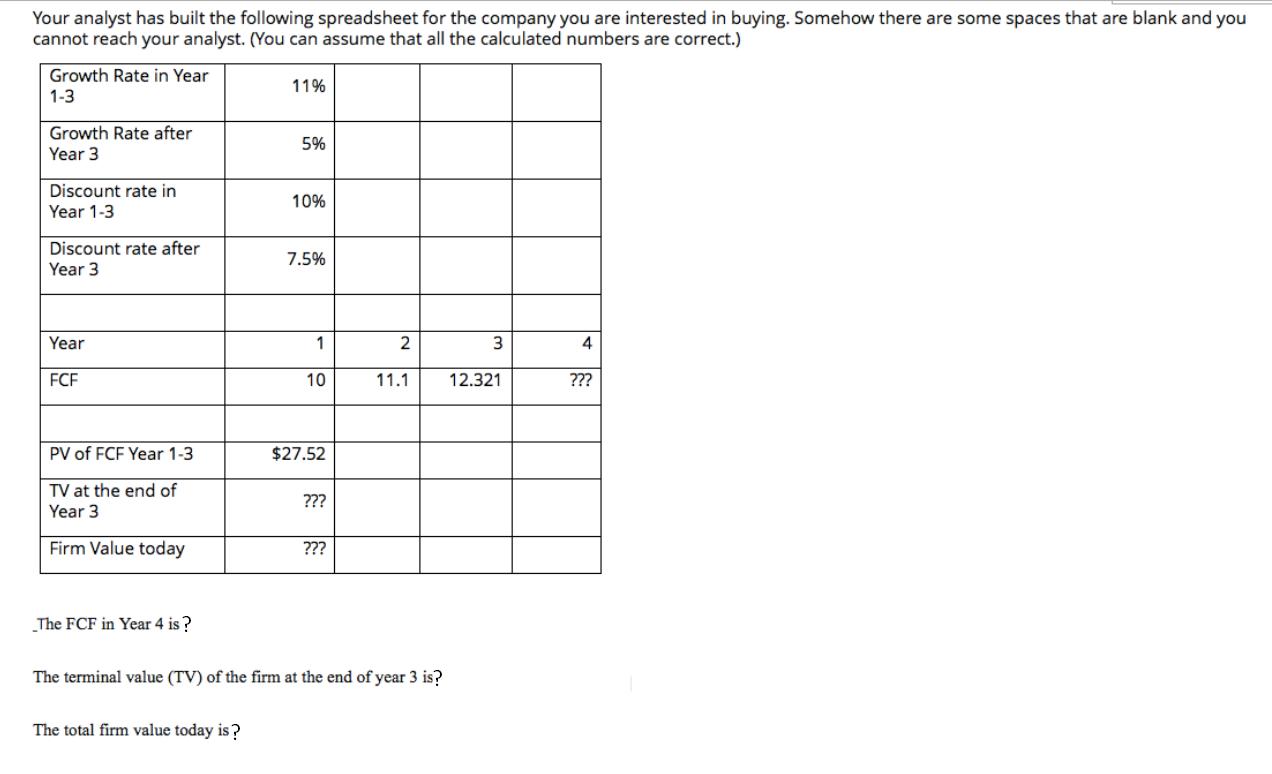

Your analyst has built the following spreadsheet for the company you are interested in buying. Somehow there are some spaces that are blank and

Your analyst has built the following spreadsheet for the company you are interested in buying. Somehow there are some spaces that are blank and you cannot reach your analyst. (You can assume that all the calculated numbers are correct.) Growth Rate in Year 1-3 Growth Rate after Year 3 Discount rate in Year 1-3 Discount rate after Year 3 Year FCF PV of FCF Year 1-3 TV at the end of Year 3 Firm Value today The FCF in Year 4 is? 11% The total firm value today is? 5% 10% 7.5% 1 10 $27.52 ??? ??? 2 11.1 The terminal value (TV) of the firm at the end of year 3 is? 3 12.321 4 ???

Step by Step Solution

3.57 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

I see a spreadsheet for financial analysis specifically for calculating the future cash flows and va...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Corporate Finance

Authors: Robert Parrino, David S. Kidwell, Thomas W. Bates

3rd edition

1118845897, 978-1118845899

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App