Answered step by step

Verified Expert Solution

Question

1 Approved Answer

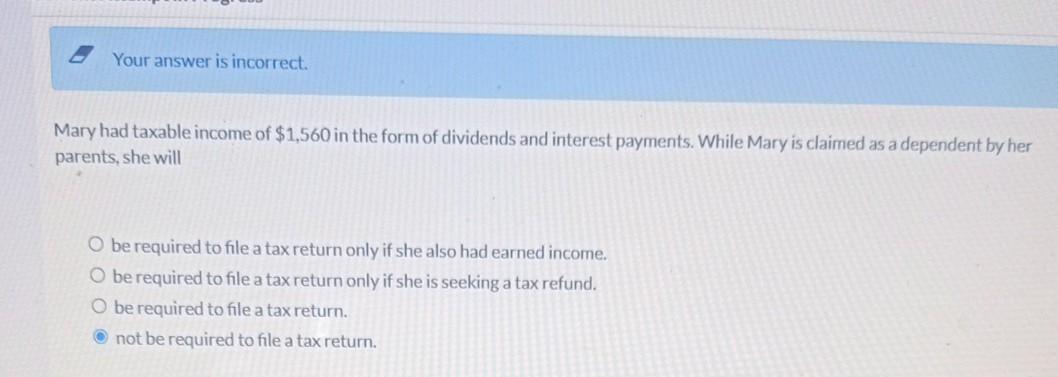

Your answer is incorrect. Mary had taxable income of $1,560 in the form of dividends and interest payments. While Mary is claimed as a dependent

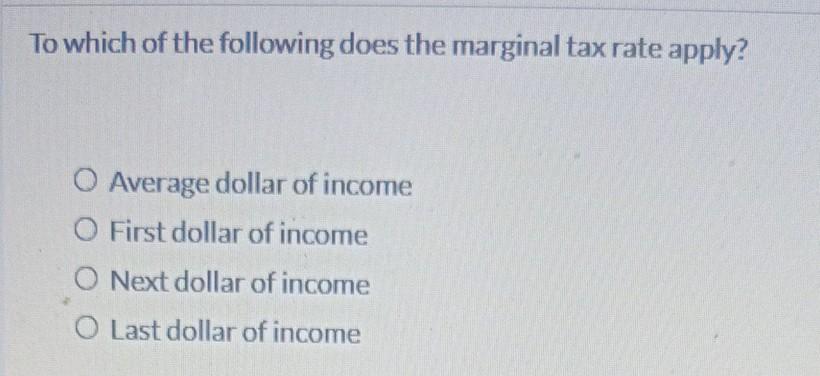

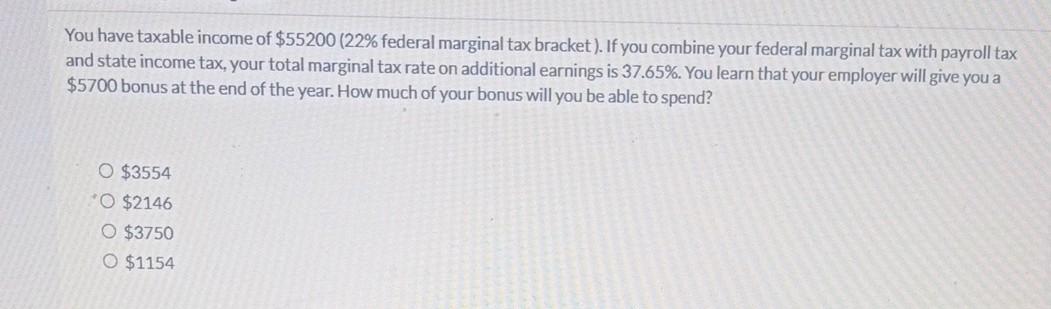

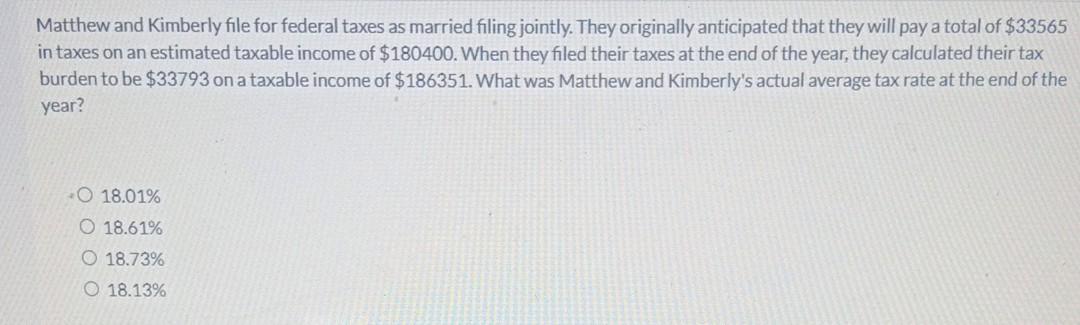

Your answer is incorrect. Mary had taxable income of $1,560 in the form of dividends and interest payments. While Mary is claimed as a dependent by her parents, she will O be required to file a tax return only if she also had earned income. O be required to file a tax return only if she is seeking a tax refund. O be required to file a tax return. not be required to file a tax return. To which of the following does the marginal tax rate apply? O Average dollar of income O First dollar of income O Next dollar of income O Last dollar of income You have taxable income of $55200 (22% federal marginal tax bracket). If you combine your federal marginal tax with payroll tax and state income tax, your total marginal tax rate on additional earnings is 37.65%. You learn that your employer will give you a $5700 bonus at the end of the year. How much of your bonus will you be able to spend? O $3554 *O $2146 O $3750 O $1154 Matthew and Kimberly file for federal taxes as married filing jointly. They originally anticipated that they will pay a total of $33565 in taxes on an estimated taxable income of $180400. When they filed their taxes at the end of the year, they calculated their tax burden to be $33793 on a taxable income of $186351. What was Matthew and Kimberly's actual average tax rate at the end of the year? -0 18.01% O 18.61% O 18.73% O 18.13% A progressive tax is one in which O you pay the same regardless of earnings. O taxes are used for progressive services. O you pay less if you earn more. O you pay more if you earn more

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started