Answered step by step

Verified Expert Solution

Question

1 Approved Answer

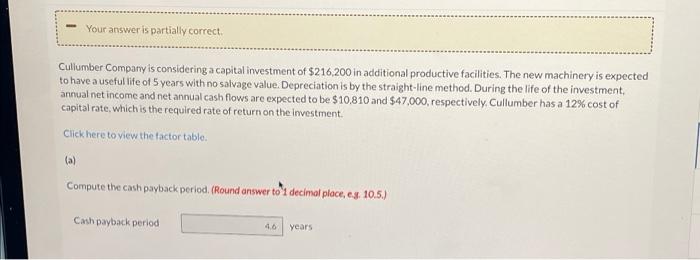

Your answer is partially correct. Cullumber Company is considering a capital investment of $216,200 in additional productive facilities. The new machinery is expected to

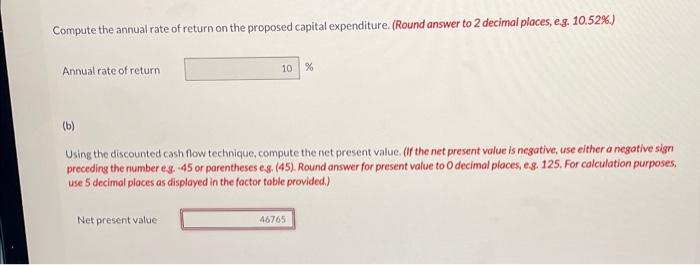

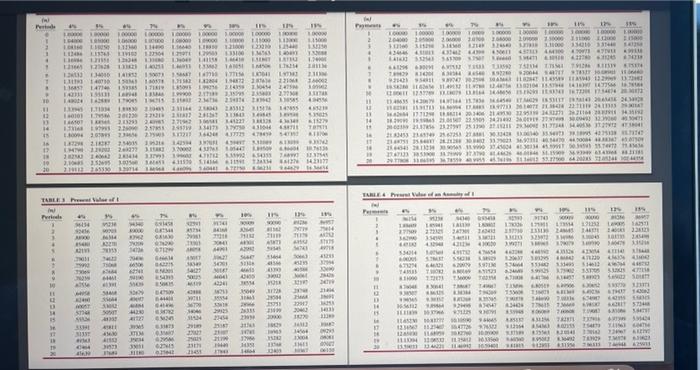

Your answer is partially correct. Cullumber Company is considering a capital investment of $216,200 in additional productive facilities. The new machinery is expected to have a useful life of 5 years with no salvage value. Depreciation is by the straight-line method. During the life of the investment. annual net income and net annual cash flows are expected to be $10,810 and $47,000, respectively. Cullumber has a 12% cost of capital rate, which is the required rate of return on the investment. Click here to view the factor table. (a) Compute the cash payback period. (Round answer to 1 decimal place, eg. 10.5.) Cash payback period 46 years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started