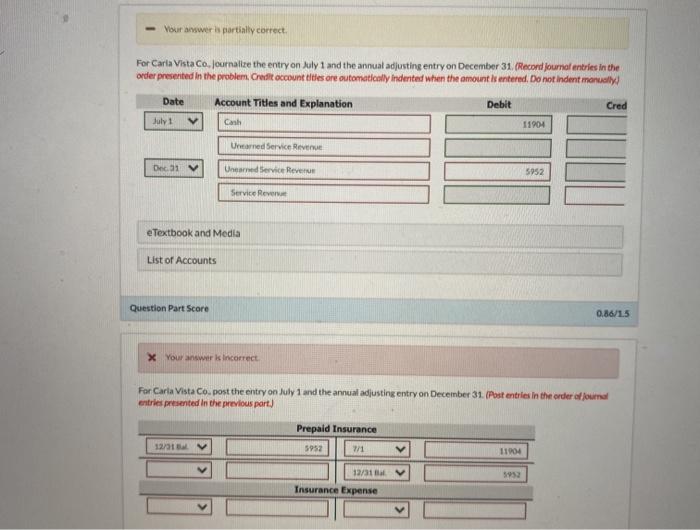

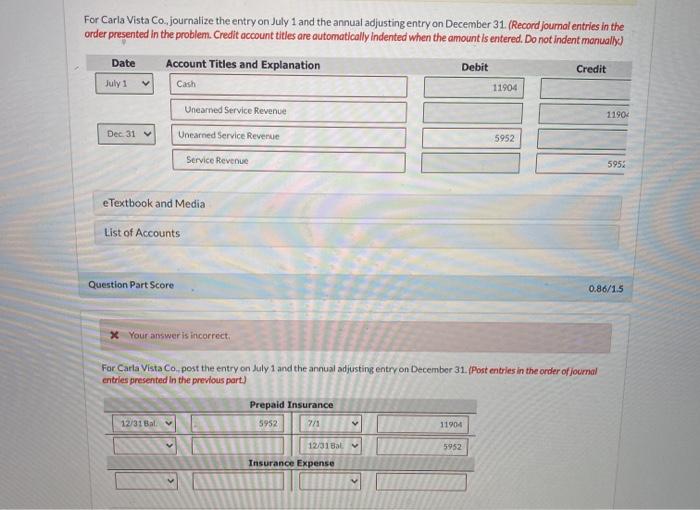

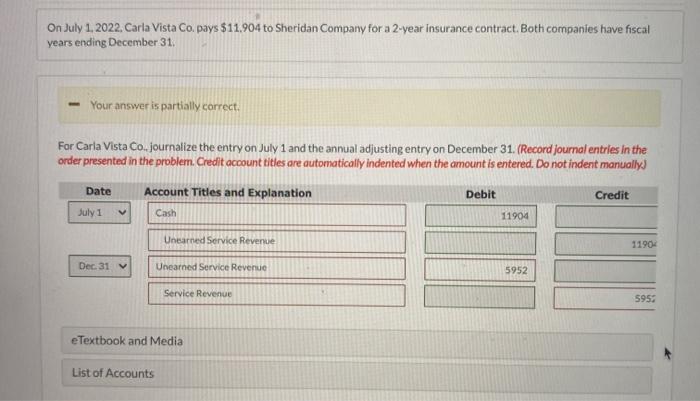

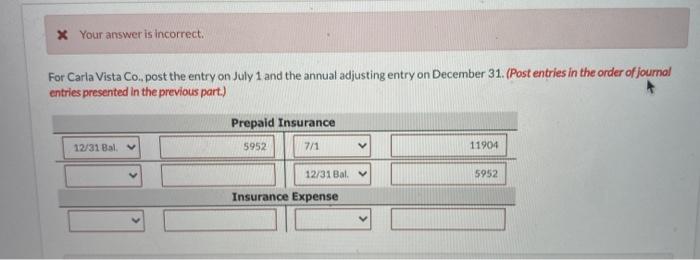

- Your answer is partially correct For Carla Vista Colournalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Cradle occountitles are automatically indented when the amount is entered. Do not indent manually Date Account Titles and Explanation Debit Cred July 1 Cash 11904 Uncanned Service Revenue Dec 31 Uneared Service Revenue 5952 Service Rever e Textbook and Media List of Accounts Question Part Score 0.86/15 x Your answer is incorrect For Carla Vista Co post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of journal entries presented in the previous part.) Prepaid Insurance 5952 71 12/31 1104 5952 12/31 Insurance Expense For Carla Vista Co., journalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit Cash Date July 1 V 11904 Uncanned Service Revenue 11904 Dec. 31 Unearned Service Revenue 5952 Service Revenue 5954 e Textbook and Media List of Accounts Question Part Score 0.86/1.5 X Your answer is incorrect For Carla Vista Co post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of journal entries presented in the previous part) Prepaid Insurance 5952 71 12/31 Bal 11904 12/31 Bal 5952 Insurance Expense On July 1, 2022. Carla Vista Co. pays $11.904 to Sheridan Company for a 2-year Insurance contract. Both companies have fiscal years ending December 31: Your answer is partially correct. For Carla Vista Co. journalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually Account Titles and Explanation Debit Credit July 1 Cash 11904 Date Unearned Service Revenue 11904 Dec. 31 Unearned Service Revenue 5952 Service Revenue 595 e Textbook and Media List of Accounts x Your answer is incorrect. For Carla Vista Co., post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of Journal entries presented in the previous part.) Prepaid Insurance 12/31 Bal. 5952 7/1 11904 12/31 Bal. 5952 Insurance Expense - Your answer is partially correct For Carla Vista Colournalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Cradle occountitles are automatically indented when the amount is entered. Do not indent manually Date Account Titles and Explanation Debit Cred July 1 Cash 11904 Uncanned Service Revenue Dec 31 Uneared Service Revenue 5952 Service Rever e Textbook and Media List of Accounts Question Part Score 0.86/15 x Your answer is incorrect For Carla Vista Co post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of journal entries presented in the previous part.) Prepaid Insurance 5952 71 12/31 1104 5952 12/31 Insurance Expense For Carla Vista Co., journalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit Cash Date July 1 V 11904 Uncanned Service Revenue 11904 Dec. 31 Unearned Service Revenue 5952 Service Revenue 5954 e Textbook and Media List of Accounts Question Part Score 0.86/1.5 X Your answer is incorrect For Carla Vista Co post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of journal entries presented in the previous part) Prepaid Insurance 5952 71 12/31 Bal 11904 12/31 Bal 5952 Insurance Expense On July 1, 2022. Carla Vista Co. pays $11.904 to Sheridan Company for a 2-year Insurance contract. Both companies have fiscal years ending December 31: Your answer is partially correct. For Carla Vista Co. journalize the entry on July 1 and the annual adjusting entry on December 31. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when the amount is entered. Do not indent manually Account Titles and Explanation Debit Credit July 1 Cash 11904 Date Unearned Service Revenue 11904 Dec. 31 Unearned Service Revenue 5952 Service Revenue 595 e Textbook and Media List of Accounts x Your answer is incorrect. For Carla Vista Co., post the entry on July 1 and the annual adjusting entry on December 31. (Post entries in the order of Journal entries presented in the previous part.) Prepaid Insurance 12/31 Bal. 5952 7/1 11904 12/31 Bal. 5952 Insurance Expense