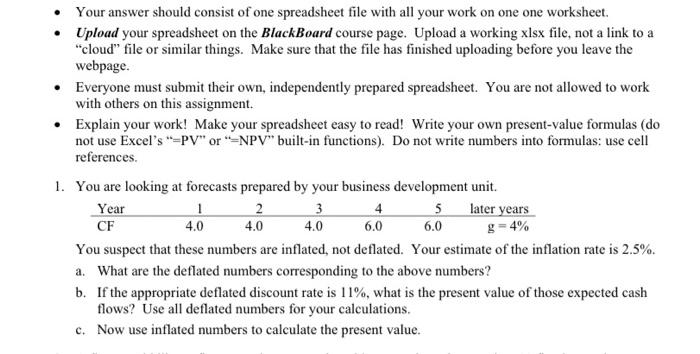

- Your answer should consist of one spreadsheet file with all your work on one one worksheet. - Upload your spreadsheet on the BlackBoard course page. Upload a working xlsx file, not a link to a "cloud" file or similar things. Make sure that the file has finished uploading before you leave the webpage. - Everyone must submit their own, independently prepared spreadsheet. You are not allowed to work with others on this assignment. - Explain your work! Make your spreadsheet easy to read! Write your own present-value formulas (do not use Excel's "=PV" or "=NPV" built-in functions). Do not write numbers into formulas: use cell references. 1. You are looking at forecasts prepared by your business development unit. You suspect that these numbers are inflated, not deflated. Your estimate of the inflation rate is 2.5%. a. What are the deflated numbers corresponding to the above numbers? b. If the appropriate deflated discount rate is 11%, what is the present value of those expected cash flows? Use all deflated numbers for your calculations. c. Now use inflated numbers to calculate the present value. - Your answer should consist of one spreadsheet file with all your work on one one worksheet. - Upload your spreadsheet on the BlackBoard course page. Upload a working xlsx file, not a link to a "cloud" file or similar things. Make sure that the file has finished uploading before you leave the webpage. - Everyone must submit their own, independently prepared spreadsheet. You are not allowed to work with others on this assignment. - Explain your work! Make your spreadsheet easy to read! Write your own present-value formulas (do not use Excel's "=PV" or "=NPV" built-in functions). Do not write numbers into formulas: use cell references. 1. You are looking at forecasts prepared by your business development unit. You suspect that these numbers are inflated, not deflated. Your estimate of the inflation rate is 2.5%. a. What are the deflated numbers corresponding to the above numbers? b. If the appropriate deflated discount rate is 11%, what is the present value of those expected cash flows? Use all deflated numbers for your calculations. c. Now use inflated numbers to calculate the present value