Answered step by step

Verified Expert Solution

Question

1 Approved Answer

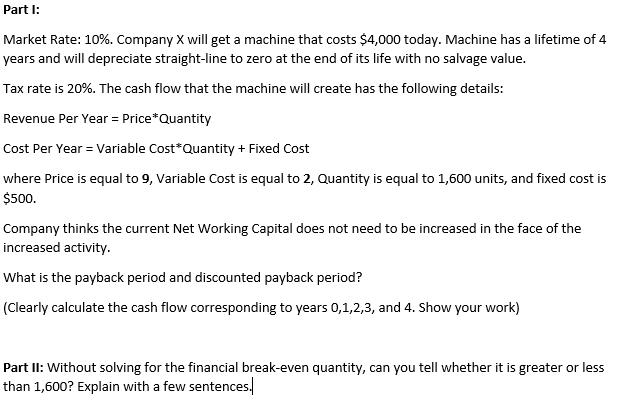

Part I: Market Rate: 10%. Company X will get a machine that costs $4,000 today. Machine has a lifetime of 4 years and will

Part I: Market Rate: 10%. Company X will get a machine that costs $4,000 today. Machine has a lifetime of 4 years and will depreciate straight-line to zero at the end of its life with no salvage value. Tax rate is 20%. The cash flow that the machine will create has the following details: Revenue Per Year = Price*Quantity Cost Per Year = Variable Cost*Quantity + Fixed Cost where Price is equal to 9, Variable Cost is equal to 2, Quantity is equal to 1,600 units, and fixed cost is $500. Company thinks the current Net Working Capital does not need to be increased in the face of the increased activity. What is the payback period and discounted payback period? (Clearly calculate the cash flow corresponding to years 0,1,2,3, and 4. Show your work) Part II: Without solving for the financial break-even quantity, can you tell whether it is greater or less than 1,600? Explain with a few sentences.

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

m 3 and n 1 Part II It is less than 1600 units Bre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started