Question

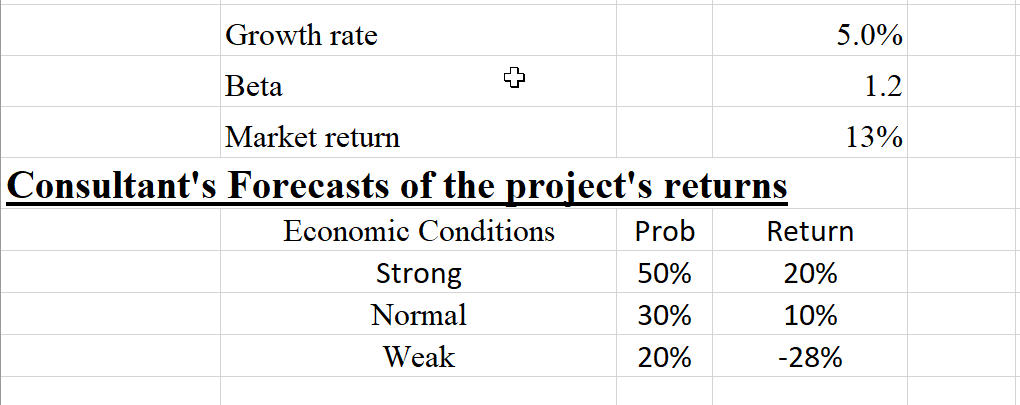

Your boss gives you a hypothetical: Assume that the risk-free rate increases, but the market risk premium (and beta) remains constant. What impact would this

Your boss gives you a hypothetical: Assume that the risk-free rate increases, but the market risk premium (and beta) remains constant. What impact would this have on the expected return on the common stock? It cannot be calculated from this information

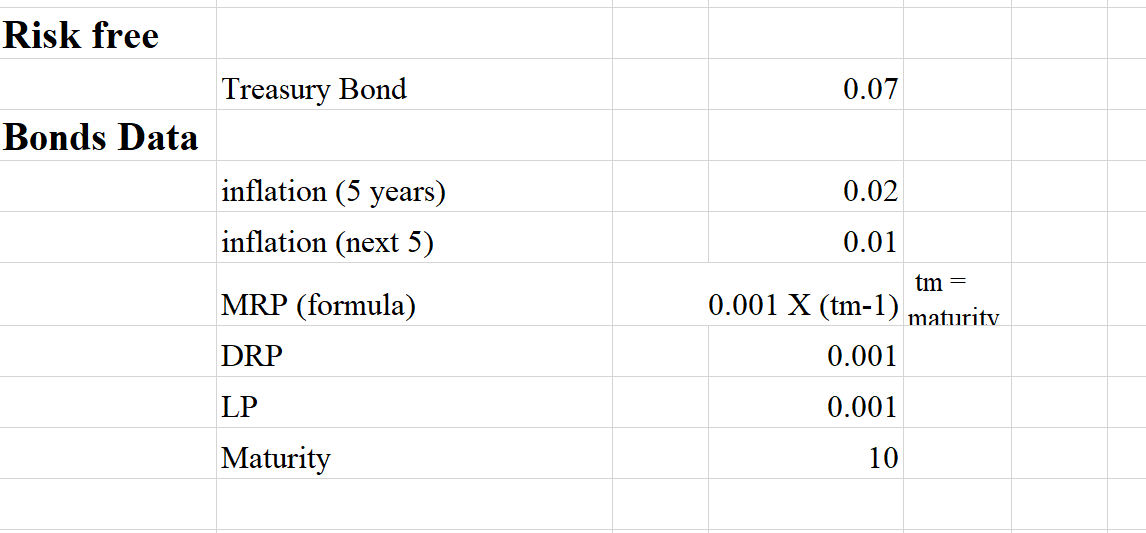

Risk free Bonds Data Treasury Bond inflation (5 years) inflation (next 5) MRP (formula) DRP LP Maturity 0.07 0.02 0.01 0.001 X (tm-1) 0.001 0.001 10 tm = maturity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

If the riskfree rate increases while the market risk premium and beta remain constant it would have ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Management Theory and Practice

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason

2nd Canadian edition

176517308, 978-0176517304

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App