Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your boss has asked you to evaluate a capital restructuring proposal. Your company Mankayane Milling Limited (MML) is an all-equity financed firm with expected perpetual

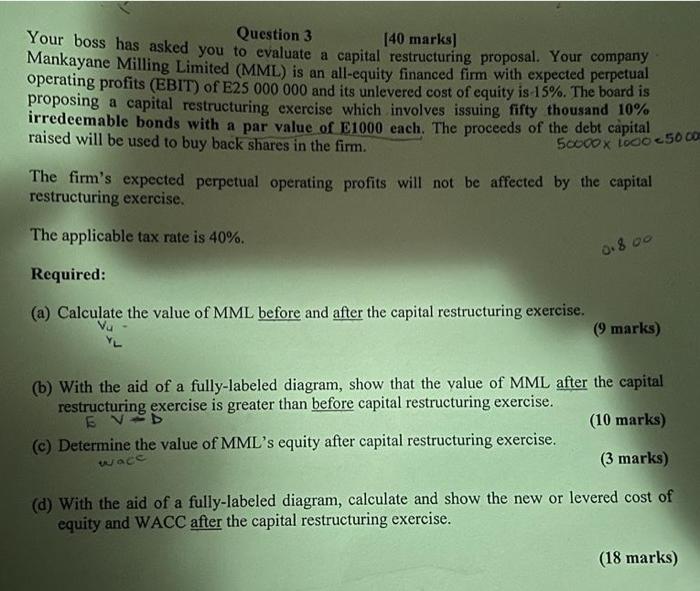

Your boss has asked you to evaluate a capital restructuring proposal. Your company Mankayane Milling Limited (MML) is an all-equity financed firm with expected perpetual operating profits (EBIT) of E25 000 000 and its unlevered cost of equity is 15%. The board is proposing a capital restructuring exercise which involves issuing fifty thousand 10% irredeemable bonds with a par value of E1000 each. The proceeds of the debt capital raised will be used to buy back shares in the firm. 50000 x 1000-50 000 The firm's expected perpetual operating profits will not be affected by the capital restructuring exercise. The applicable tax rate is 40%. Required: (a) Calculate the value of MML before and after the capital restructuring exercise. Vu YL 0.8.00 (9 marks) (b) With the aid of a fully-labeled diagram, show that the value of MML after the capital restructuring exercise is greater than before capital restructuring exercise. EV (10 marks) (c) Determine the value of MML's equity after capital restructuring exercise. wace (3 marks) (d) With the aid of a fully-labeled diagram, calculate and show the new or levered cost of equity and WACC after the capital restructuring exercise. (18 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started