Question

Your boss has just asked you to calculate your firm's cost of capital. Below is potentially relevant information for your calculation. What is your

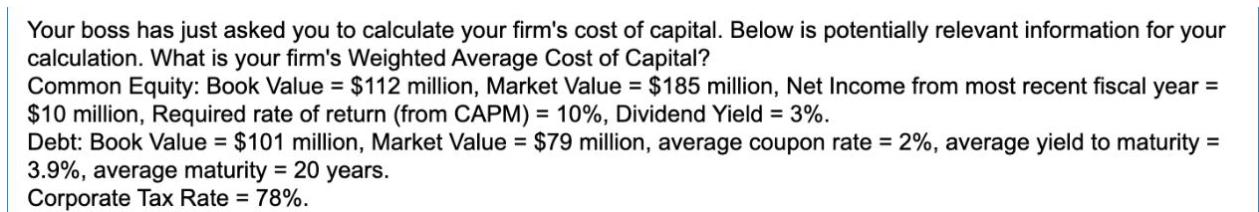

Your boss has just asked you to calculate your firm's cost of capital. Below is potentially relevant information for your calculation. What is your firm's Weighted Average Cost of Capital? Common Equity: Book Value = $112 million, Market Value = $185 million, Net Income from most recent fiscal year = $10 million, Required rate of return (from CAPM) = 10%, Dividend Yield = 3%. Debt: Book Value = $101 million, Market Value = $79 million, average coupon rate = 2%, average yield to maturity = 3.9%, average maturity = 20 years. Corporate Tax Rate = 78%.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Market Value of Debt 79 Million Market Value of Equity ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Robert Kemp, Jeffrey Waybright

2nd edition

978-0132771801, 9780132771580, 132771802, 132771586, 978-0133052152

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App