Question

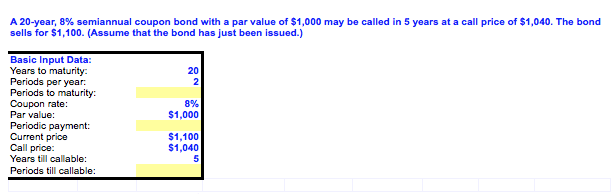

Your boss is back. This time he/she provides you a partial model to a bond valuation. This bond is a 20-year, 8% semiannual coupon bond

Your boss is back. This time he/she provides you a partial model to a bond valuation. This bond is a 20-year, 8% semiannual coupon bond with a par value of $1,000 may be called in 5 years at a call price of $1,040. The bond sells for $1,100. (Assume that the bond has been issued.) She needs you to complete the partial model for her. She needs the following to be answered. Now assume the date is October 25, 2017. Assume further that a 12%, 10-year bond was issued on July 1, 2017, pays interest semiannually (on January 1 and July 1), and sells for $1,00. Use the attached spreadsheet to find the bond's yield.

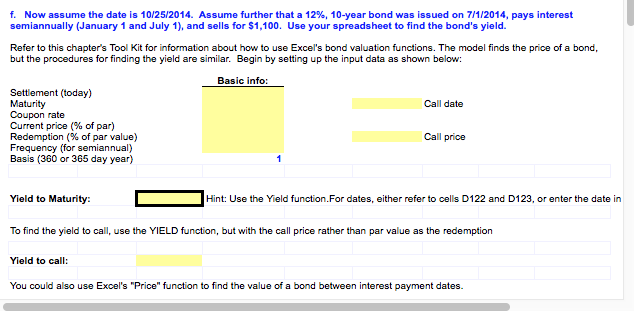

f. Now assume the date is 10/25/2014. Assume further that a 12%, 10-year bond was issued on 7/1/2014, pays interest semiannually (January 1 and July 1), and sells for $1,100. Use your spreadsheet to find the bonds yield. Refer to this chapter's Tool Kit for information about how to use Excel's bond valuation functions. The model finds the price of a bond, but the procedures for finding the yield are similar. Begin by setting up the input data as shown below: Basic info: Settlement (today) ??? Maturity ??? ??? Call date Coupon rate ??? Current price (% of par) ??? Redemption (% of par value) ??? ??? Call price Frequency (for semiannual) ??? Basis (360 or 365 day year) 1 Yield to Maturity: ??? Hint: Use the Yield function.For dates, either refer to cells D122 and D123, or enter the date in quotes, such as "10/25/2014". To find the yield to call, use the YIELD function, but with the call price rather than par value as the redemption Yield to call: ??? You could also use Excel's "Price" function to find the value of a bond between interest payment dates.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started