Answered step by step

Verified Expert Solution

Question

1 Approved Answer

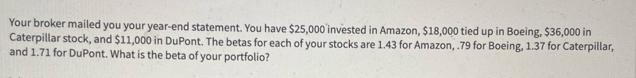

Your broker mailed you your year-end statement. You have $25,000 invested in Amazon, $18,000 tied up in Boeing, $36,000 in Caterpillar stock, and $11,000

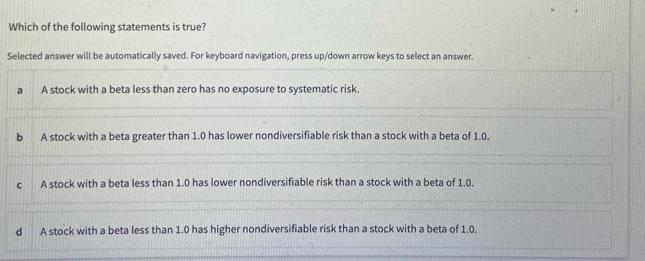

Your broker mailed you your year-end statement. You have $25,000 invested in Amazon, $18,000 tied up in Boeing, $36,000 in Caterpillar stock, and $11,000 in DuPont. The betas for each of your stocks are 1.43 for Amazon, .79 for Boeing, 1.37 for Caterpillar, and 1.71 for DuPont. What is the beta of your portfolio? Which of the following statements is true? Selected answer will be automatically saved. For keyboard navigation, press up/down arrow keys to select an answer. a A stock with a beta less than zero has no exposure to systematic risk. b A stock with a beta greater than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0. C A stock with a beta less than 1.0 has lower nondiversifiable risk than a stock with a beta of 1.0. d A stock with a beta less than 1.0 has higher nondiversifiable risk than a stock with a beta of 1.0.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below Beta of your portfolio To calculate the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started