Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your brother started the business last year with an initial investment of $1 million, and now needs an additional $1.5 million to finance the

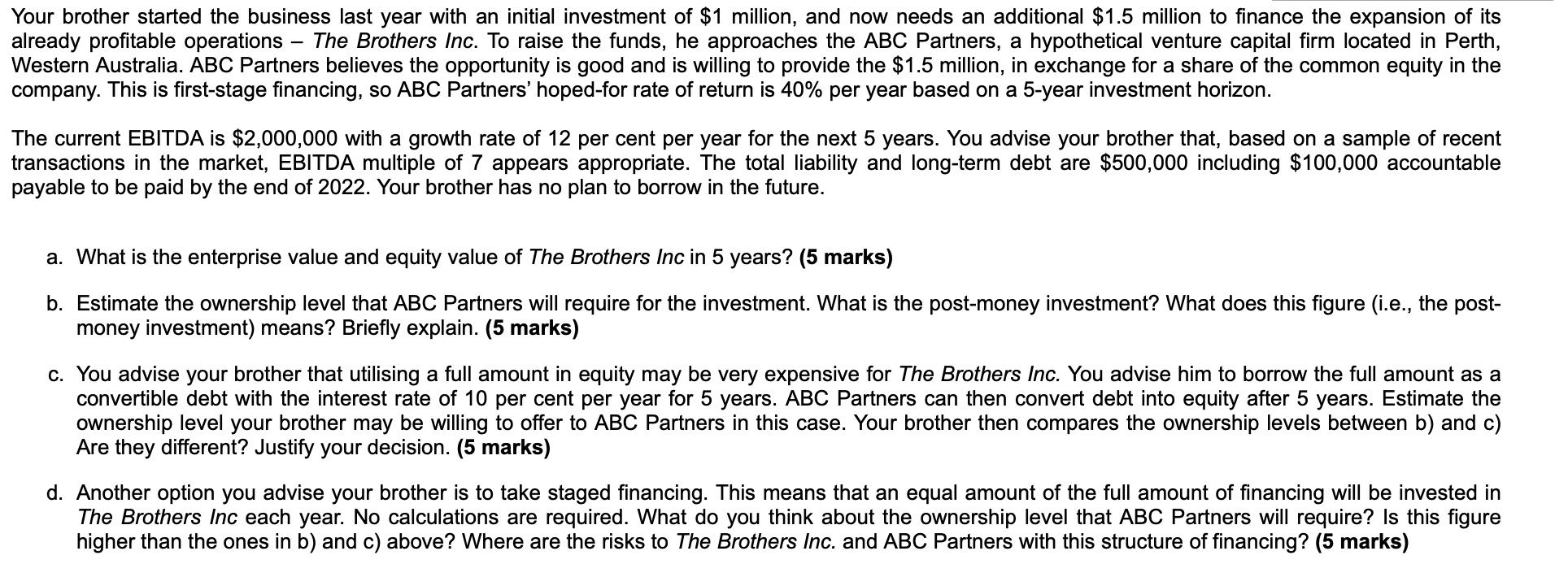

Your brother started the business last year with an initial investment of $1 million, and now needs an additional $1.5 million to finance the expansion of its already profitable operations - The Brothers Inc. To raise the funds, he approaches the ABC Partners, a hypothetical venture capital firm located in Perth, Western Australia. ABC Partners believes the opportunity is good and is willing to provide the $1.5 million, in exchange for a share of the common equity in the company. This is first-stage financing, so ABC Partners' hoped-for rate of return is 40% per year based on a 5-year investment horizon. The current EBITDA is $2,000,000 with a growth rate of 12 per cent per year for the next 5 years. You advise your brother that, based on a sample of recent transactions in the market, EBITDA multiple of 7 appears appropriate. The total liability and long-term debt are $500,000 including $100,000 accountable payable to be paid by the end of 2022. Your brother has no plan to borrow in the future. a. What is the enterprise value and equity value of The Brothers Inc in 5 years? (5 marks) b. Estimate the ownership level that ABC Partners will require for the investment. What is the post-money investment? What does this figure (i.e., the post- money investment) means? Briefly explain. (5 marks) c. You advise your brother that utilising a full amount in equi may be very expensive for The Brothers Inc. You advise him to borrow the full amount as convertible debt with the interest rate of 10 per cent per year for 5 years. ABC Partners can then convert debt into equity after 5 years. Estimate the ownership level your brother may be willing to offer to ABC Partners in this case. Your brother then compares the ownership levels between b) and c) Are they different? Justify your decision. (5 marks) d. Another option you advise your brother is to take staged financing. This means that an equal amount of the full amount of financing will be invested in The Brothers Inc each year. No calculations are required. What do you think about the ownership level that ABC Partners will require? Is this figure higher than the ones in b) and c) above? Where are the risks to The Brothers Inc. and ABC Partners with this structure of financing? (5 marks)

Step by Step Solution

★★★★★

3.40 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

The Brothers Inc Funding Analysis a Enterprise Value and Equity Value in 5 Years Project future EBITDA Year 1 2000000 1 012 2240000 Year 2 2240000 1 0...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started