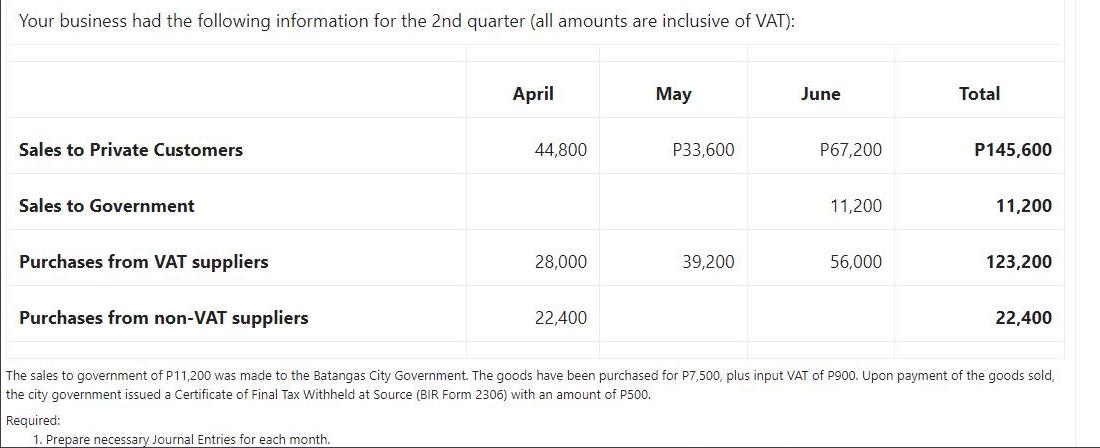

Your business had the following information for the 2nd quarter (all amounts are inclusive of VAT): Sales to Private Customers Sales to Government Purchases

Your business had the following information for the 2nd quarter (all amounts are inclusive of VAT): Sales to Private Customers Sales to Government Purchases from VAT suppliers Purchases from non-VAT suppliers April Required: 1. Prepare necessary Journal Entries for each month. 44,800 28,000 22,400 May P33,600 39,200 June P67,200 11,200 56,000 Total P145,600 11,200 123,200 22,400 The sales to government of P11,200 was made to the Batangas City Government. The goods have been purchased for P7,500, plus input VAT of P900. Upon payment of the goods sold, the city government issued a Certificate of Final Tax Withheld at Source (BIR Form 2306) with an amount of P500.

Step by Step Solution

3.24 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below April Debit Accounts Receivable Private ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started