Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your business owner, Martin, has decided to expand his business and has bought an office in a nearby suburb. Martin has appointed one of

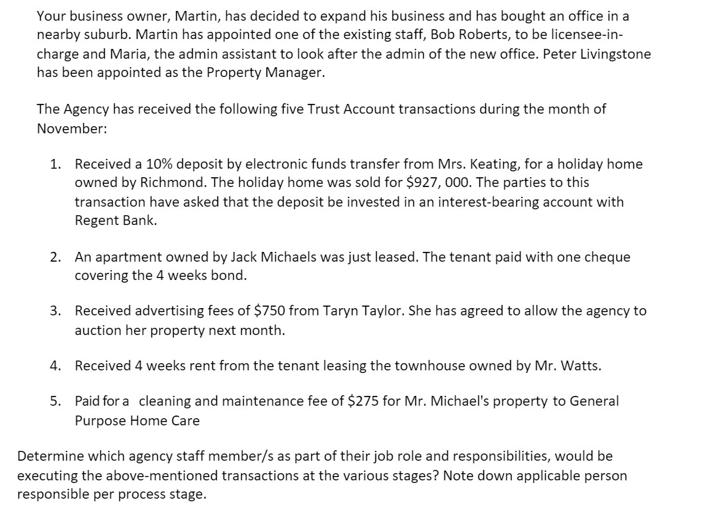

Your business owner, Martin, has decided to expand his business and has bought an office in a nearby suburb. Martin has appointed one of the existing staff, Bob Roberts, to be licensee-in- charge and Maria, the admin assistant to look after the admin of the new office. Peter Livingstone has been appointed as the Property Manager. The Agency has received the following five Trust Account transactions during the month of November: 1. Received a 10% deposit by electronic funds transfer from Mrs. Keating, for a holiday home owned by Richmond. The holiday home was sold for $927, 000. The parties to this transaction have asked that the deposit be invested in an interest-bearing account with Regent Bank. 2. An apartment owned by Jack Michaels was just leased. The tenant paid with one cheque covering the 4 weeks bond. 3. Received advertising fees of $750 from Taryn Taylor. She has agreed to allow the agency to auction her property next month. 4. Received 4 weeks rent from the tenant leasing the townhouse owned by Mr. Watts. 5. Paid for a cleaning and maintenance fee of $275 for Mr. Michael's property to General Purpose Home Care Determine which agency staff member/s as part of their job role and responsibilities, would be executing the above-mentioned transactions at the various stages? Note down applicable person responsible per process stage.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Received a 10 deposit by electronic funds transfer from Mrs Keating for a holiday home owned by Richmond Bob Roberts Licenseeincharge He would likely ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started