Question

Your CFO has asked you to analyze the attached financial statements. In addition, you are provided the following information: Cost of debt 7% Cost of

Your CFO has asked you to analyze the attached financial statements. In addition, you are provided the following information:

Cost of debt 7%

Cost of equity 20%

Tax rate 25%

FCF Terminal Growth Rate 2%

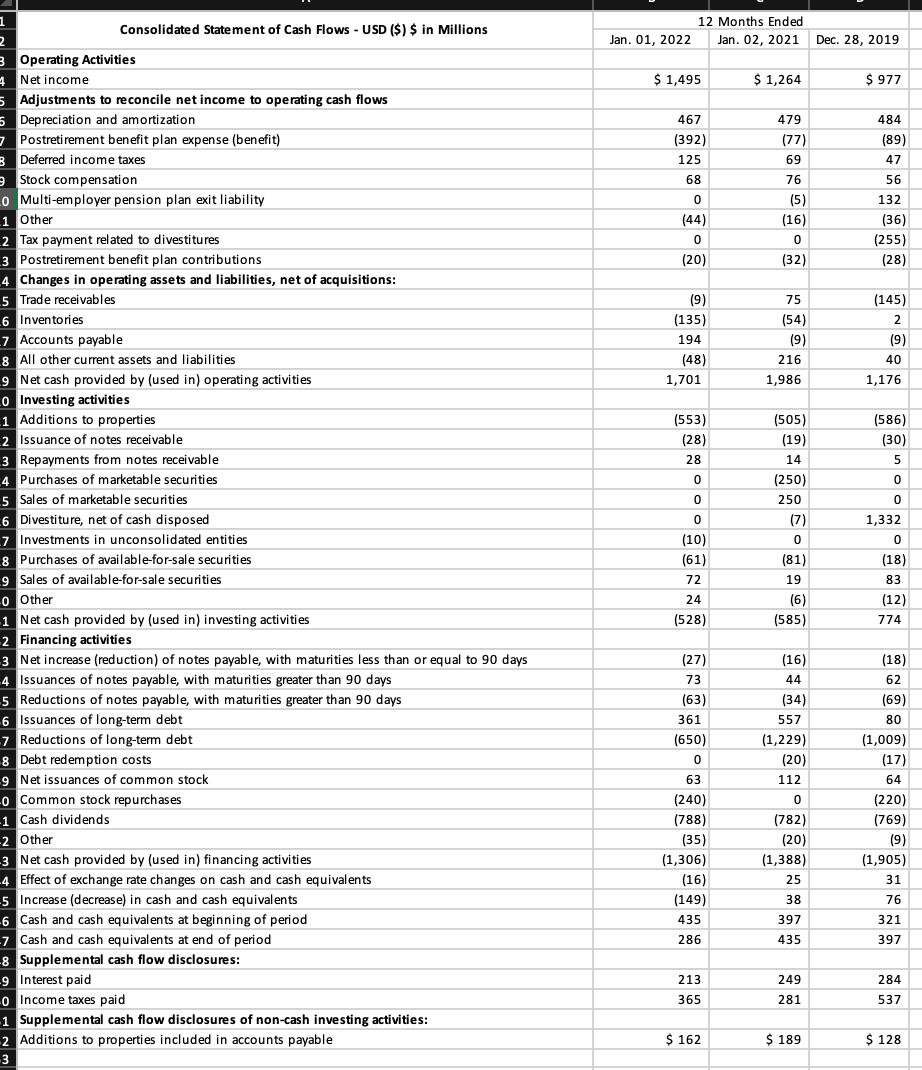

Assume that the firm's net income is the best indicator of the firm's future free cash flows. Using the free cash flow approach to valuation, what was the firm's value and stock price at the end of most recent calendar year?

You should be sure to include an explanation of any assumptions and be sure to forecast no less than 5 years for your analysis.?

![Consolidated Statement of Income Statement - USD ($) $ in Millions Income Statement [Abstract] Net sales Cost](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/01/63d360cd1efbd_1674797260393.png)

![Consolidated Balance Sheet Statement - USD ($) $ in Millions Assets, Current [Abstract] Cash and cash](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2023/01/63d360dc1fa02_1674797275084.png)

Consolidated Statement of Income Statement - USD ($) $ in Millions Income Statement [Abstract] Net sales Cost of goods sold Selling, general and administrative expense Operating profit Interest expense Other income (expense), net Income before income taxes Income taxes Earnings (loss) from unconsolidated entities Net income Net income (loss) attributable to noncontrolling interests Net income attributable to company Basic Diluted Price Per Share Jan. 01, 2022 12 Months Ended Jan. 02, 2021 $ 14,181 9,621 2,808 1,752 223 437 1,966 474 3 1,495 7 $ 1,488 $4.36 $4.33 64.42 $ 13,770 9,043 2,966 1,761 281 121 1,601 323 (14) 1,264 13 $ 1,251 $ 3.65 $ 3.63 62.23 Dec. 28, 2019 $ 13,578 9,197 2,980 1,401 284 188 1,305 321 (7) 977 17 $ 960 $ 2.81 $ 2.80 69.16

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the firms value and stock price using the free cash flow approach to valuation we need to estimate the future free cash flows and the terminal value Heres how you can perform the analysis ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started