Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your city has a voluntary health and welfare organization (VHWD) that provides musical opportunities for inner-city youth. It does not use fund accounting, but

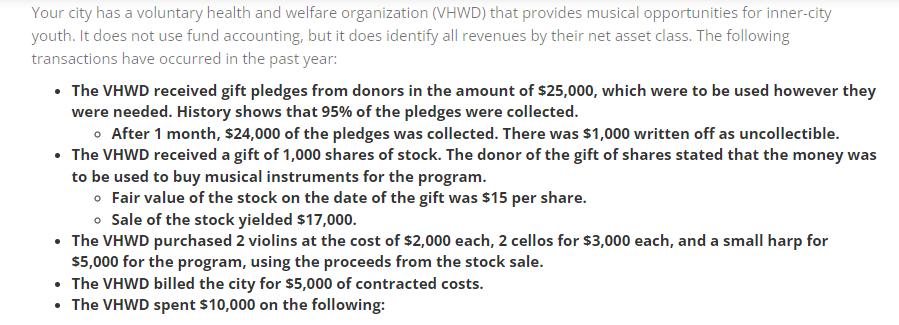

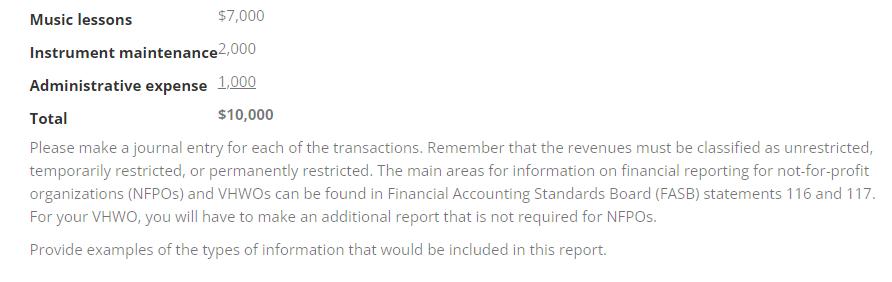

Your city has a voluntary health and welfare organization (VHWD) that provides musical opportunities for inner-city youth. It does not use fund accounting, but it does identify all revenues by their net asset class. The following transactions have occurred in the past year: The VHWD received gift pledges from donors in the amount of $25,000, which were to be used however they were needed. History shows that 95% of the pledges were collected. After 1 month, $24,000 of the pledges was collected. There was $1,000 written off as uncollectible. The VHWD received a gift of 1,000 shares of stock. The donor of the gift of shares stated that the money was to be used to buy musical instruments for the program. o Fair value of the stock on the date of the gift was $15 per share. o Sale of the stock yielded $17,000. The VHWD purchased 2 violins at the cost of $2,000 each, 2 cellos for $3,000 each, and a small harp for $5,000 for the program, using the proceeds from the stock sale. The VHWD billed the city for $5,000 of contracted costs. The VHWD spent $10,000 on the following: $7,000 Music lessons Instrument maintenance2,000 Administrative expense 1,000 $10,000 Total Please make a journal entry for each of the transactions. Remember that the revenues must be classified as unrestricted, temporarily restricted, or permanently restricted. The main areas for information on financial reporting for not-for-profit organizations (NFPOS) and VHWOs can be found in Financial Accounting Standards Board (FASB) statements 116 and 117. For your VHWO, you will have to make an additional report that is not required for NFPOs, Provide examples of the types of information that would be included in this report.

Step by Step Solution

★★★★★

3.36 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entry 1 Debit Cash 25000 Credit Unrestricted revenues 25000 Journal Entry 2 Debit Unrestrict...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started