Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Your client, CK Ltd (CK), is a manufacturer of machinery used in the coal extraction industry. You are currently planning the audit of the

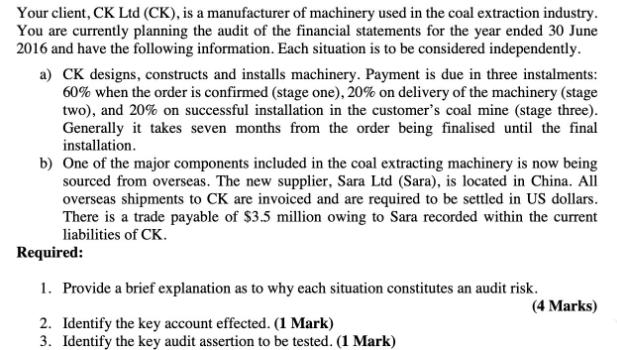

Your client, CK Ltd (CK), is a manufacturer of machinery used in the coal extraction industry. You are currently planning the audit of the financial statements for the year ended 30 June 2016 and have the following information. Each situation is to be considered independently. a) CK designs, constructs and installs machinery. Payment is due in three instalments: 60% when the order is confirmed (stage one), 20% on delivery of the machinery (stage two), and 20% on successful installation in the customer's coal mine (stage three). Generally it takes seven months from the order being finalised until the final installation. b) One of the major components included in the coal extracting machinery is now being sourced from overseas. The new supplier, Sara Ltd (Sara), is located in China. All overseas shipments to CK are invoiced and are required to be settled in US dollars. There is a trade payable of $3.5 million owing to Sara recorded within the current liabilities of CK. Required: 1. Provide a brief explanation as to why each situation constitutes an audit risk. 2. Identify the key account effected. (1 Mark) 3. Identify the key audit assertion to be tested. (1 Mark) (4 Marks)

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

a 1 CK recognises revenue over three stages as the contract is completed This presents a risk that r...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started