Your client is Caribou Coffee Company, the second largest coffee retailer in the United States. Caribou sells coffee, tea, and bakery goods in 415 company-owned

Your client is Caribou Coffee Company, the second largest coffee retailer in the United States. Caribou sells coffee, tea, and bakery goods in 415 company-owned coffeehouses. The audit manager on the Caribou engagement has asked you to verify client managements assertions related to its deferred revenue account. You are part of the audit team conducting the 2022 audit and are currently in the planning stages of the engagement, which includes assessing risk and planning procedures.

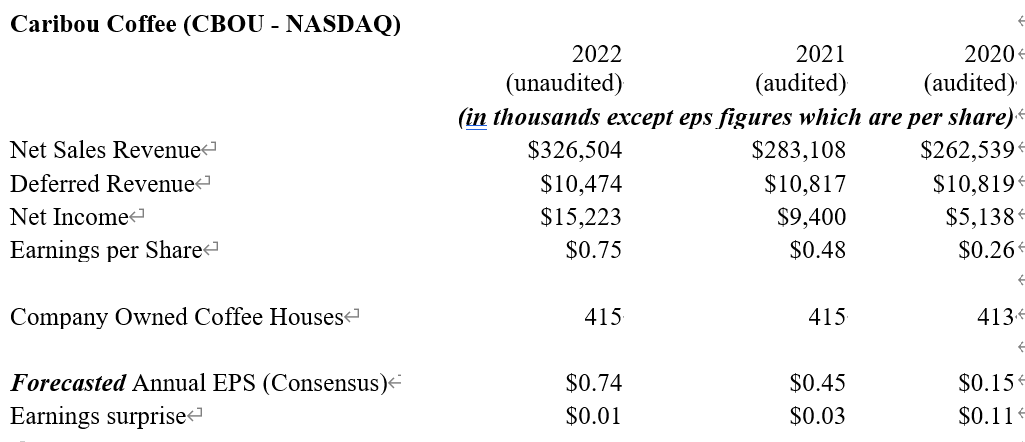

Suppose the following excerpt is from Caribous 2022, 2021, and 2020 financial statements and the notes to their 2021 financial statements:

Press Release: Caribou Coffee reported revenues of $326.5 million and earnings per share of $0.75 compared to consensus analysts' predictions of $324.5 million and earnings per share of $0.74. The stock is trading up today on news of the positive earnings surprise at a 52-week high of $18.84 per share, giving it a P/E multiple of 25 times earnings. Caribou management attributes the earnings surprise to better than expected sales per store and revenue from its loyalty card and gift card programs.

From Notes to Caribous 2022 Unaudited Financial Statements

Deferred Revenue (unaudited balance: $10,474,000)

The Company sells gift cards of various denominations. Cash receipts related to gift card sales are deferred when initially received and revenue is recognized when the card is redeemed and the related products are delivered to the customer. Such amounts are classified as a current liability on the Companys consolidated balance sheets.

The Company will honor all gift cards presented for payment; however, the Company has determined that the likelihood of redemption is remote for certain card balances due to long periods of inactivity (abandoned). The Company estimates the value of abandoned gift cards based on its experience with unused card balances. The Company recognizes a portion of this estimate in coffeehouse sales as gift cards are redeemed. The Company excludes gift card balances sold in jurisdictions which require remittance of unused balances to government agencies under unclaimed property laws.

The Company estimates that cards which have had no activity for 48 months are unlikely to be used in the future. In these circumstances, to the extent management determines there is no requirement for remitting balances to government agencies under unclaimed property laws, card balances may be recognized in coffeehouse sales.

Required:

- At a high level, what is the generic journal entry to record the sale of a gift card (what is the debit and what is the credit?) What is the generic journal entry to record a sale using a gift card? What other journal entries are suggested by the companys accounting policies for gift cards (read the footnote excerpt). The purpose of this step is to remind yourselves how the transactions should be recorded in order to proceed with the other questions. (5 points)

- Based on the information provided above, brainstorm what could go wrong with deferred revenue accounting at Caribou. Does all of the information make sense? Are the reported figures internally consistent? You should identify at least two different things that could go wrong with deferred revenue accounting. You can discuss other accounts in your explanations because journal entries to deferred revenue affect other accounts (i.e., double entry bookkeeping) but you will not receive credit for discussing what could go wrong with accounts other than deferred revenue. Your responses must also be specific to Caribou and how they do things. You will not receive full credit for generic responses like the company might not follow its procedures. (up to 5 points for each thing that can go wrong, 10 points max)

- For each thing that can wrong you identified in part (b), is there any evidence to suggest that the thing that could go wrong is, indeed, going wrong? You should consider the account balances, trends in the data, and the other information provided above. You will not receive full credit for this question unless you use the financial statement account balances, footnotes, and/or the other information above in your response. (up to 5 points for each thing that can go wrong, 10 points max)

Caribou Coffee (CBOU - NASDAQ) NetSalesRevenueDeferredRevenueNetIncomeEarningsperShareCompanyOwnedCoffeeHousesForecastedAnnualEPS(Consensus)Earningssurprise2022(unaudited)$326,504$10,474$15,223$0.75415$0.74$0.012021(audited)$283,108$10,817$9,400$0.48415$0.45$0.032020(audited)$262,539$10,819$5,138$0.26413$0.15$0.11 Caribou Coffee (CBOU - NASDAQ) NetSalesRevenueDeferredRevenueNetIncomeEarningsperShareCompanyOwnedCoffeeHousesForecastedAnnualEPS(Consensus)Earningssurprise2022(unaudited)$326,504$10,474$15,223$0.75415$0.74$0.012021(audited)$283,108$10,817$9,400$0.48415$0.45$0.032020(audited)$262,539$10,819$5,138$0.26413$0.15$0.11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started