Question

Your client sells his duplex for $ 420,000. He occupies the ground floor and receives a rent of $ 900 on the 1st of each

Your client sells his duplex for $ 420,000. He occupies the ground floor and receives a rent of $ 900 on the 1st of each month. The sale will take place on May 12, 2028. His mortgage is at 3%. The taxes have been fully paid by the seller. / 8

Municipal taxes are $ 3,400 School taxes are $ 826 N.B .: Round up the cents to the nearest dollar.

Write your steps on the next page.

Complete the following table TAX(GST), which is calculated at a rate of 5%

TAX (QST), which is calculated at a rate of 9.975%

Accrued interest :

Penalty:

School tax adjustments:

Municipal tax adjustments:

Rent adjustments:

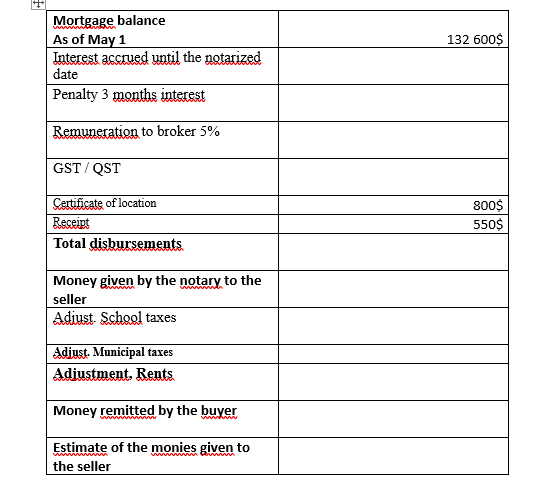

132 600$ + Mortgage balance As of May 1 Interest accrued until the notarized date Penalty 3 months interest Remuneration to broker 5% GST/QST Certificate of location Receipt Total disbursements. 800$ 550$ Money given by the notary to the seller Adiust- School taxes Adjust. Municipal taxes Adjustment. Rents Money remitted by the buyer Estimate of the monies given to the seller 132 600$ + Mortgage balance As of May 1 Interest accrued until the notarized date Penalty 3 months interest Remuneration to broker 5% GST/QST Certificate of location Receipt Total disbursements. 800$ 550$ Money given by the notary to the seller Adiust- School taxes Adjust. Municipal taxes Adjustment. Rents Money remitted by the buyer Estimate of the monies given to the sellerStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started