Question

Your client Shobha has been running her business Florals R Us (Florals) for the past four years as a sole proprietorship. This was great because

Your client Shobha has been running her business Florals R Us (Florals) for the past four years as a sole proprietorship. This was great because she was able to use the losses from the business against her other sources of income. However, now that the business is no longer in the start-up phase, Shobha is expecting that Florals will become exponentially profitable. She would like to incorporate the business and use the tax tools such as the small business deduction (SBD) to minimize the tax.

A few details:

The business has generated an operating loss of $10,000 in the current year.

Shobha has no other income sources this year.

Her notice of assessment shows a capital loss of $70,000 from prior years. (can it be carried forward to the future.)

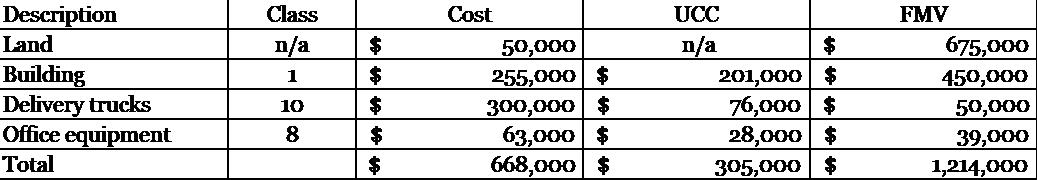

She has provided with the following assets and their related values.

Required:

Your client Shobha has heard from a friend that she could transfer the assets of the proprietorship to the corporation tax free. She does not want to pay taxes when transferring the assets. She has asked you to explain how this works and what she needs to do. She would be the sole shareholder of any new corporation.

Ensure you discuss things such as the conditions that must be met, the elected amount (for all parties, the range), Calculate the elected amounts required to minimize taxes (and why), and the consideration Shobha should take back and the impact of this.

Description Land Building Delivery trucks Office equipment Total Class n/a 1 10 8 $ $ $ $ $ Cost 50,000 255,000 $ 300,000 $ 63,000 $ 668,000 $ UCC n/a $ 201,000 $ 76,000 $ 28,000 $ $ 305,000 FMV 675,000 450,000 50,000 39,000 1,214,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To transfer the assets of the proprietorship to the corporation taxfree Shobha can utilize a provision in the Income Tax Act known as a Section 85 rol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started